[Interact Analysis] US tariff increases, the impact on the US and China markets for EV and batteries

In this insight Yvonne Zhang, Research Associate at Interact Analysis, provides an overview of the current trade in electric vehicles (EVs) and li-ion batteries between China and the US as well as the potential impacts of the tariff increases.

On May 14, the Biden administration announced the US will impose additional tariffs on $18 billion worth of goods from China, which includes a tariff increase from 25% to 100% on electric vehicles (EVs), and from 7.5% to 25% on lithium-ion (li-ion) batteries for electric vehicles in 2024.

This insight will provide a brief overview of the current trade in electric vehicles and li-ion batteries between China and the US, including analysis of the potential impacts of this round of tariff increases on both sides.

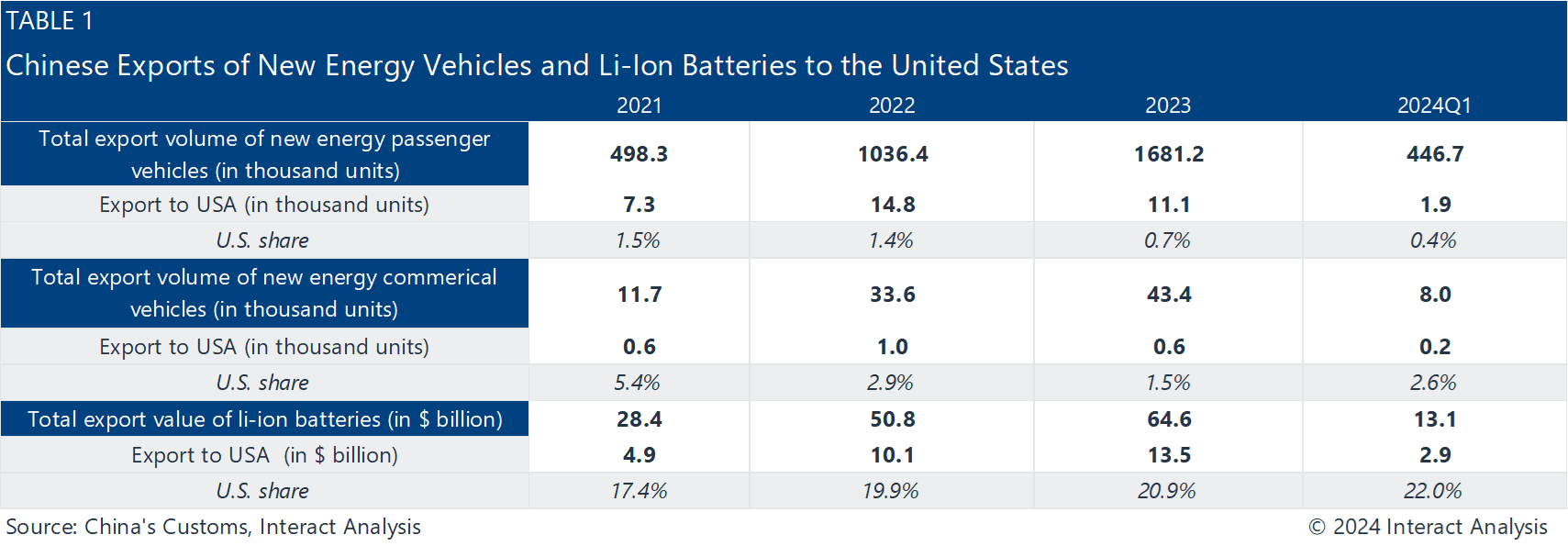

China’s EV exports to the United States have been declining in recent years, falling to less than 0.5% of total exports in 2023, according to data from China Customs. Strong demand for new energy vehicles (including battery electric and hybrid types) has driven exports of Chinese automobiles, surpassing 5.1 million units in 2023 with a 57.4% year-on-year increase. New energy vehicle exports reached 1.7 million units – a 61.2% year-on-year increase – taking the share of total exports from 25.5% in 2021 to 34.8% in the first quarter of 2024. However, in 2023, exports of new energy vehicles from China to the US dropped by 25.6% year-on-year to 12,000 units, resulting in the share of new energy vehicle exports from China to the US falling from 1.6% in 2021 to 0.7% last year. The share of new energy vehicle exports from China to the US dropped still further to less than 0.5% in the first quarter of 2024.

For new energy passenger vehicles, China’s exports to the United States consistently declined from 1.5% in 2021 to 0.4% in the first quarter of 2024. Meanwhile, exports of new energy commercial vehicles to the United States saw an increase in the first quarter of 2024 – up by 47.9% compared with the same period last year – leading to an increase to 2.6% of China’s total new energy commercial vehicle exports. Nevertheless, this marks a significant decrease from a 5.4% share of Chinese new energy commercial vehicle exports in 2021.

The United States remains China’s largest export destination for li-ion batteries

In 2021, the United States was the top destination for China’s li-ion battery exports, and in 2023, China exported li-ion batteries worth a staggering $13.5 billion to the US, marking a 40.1% year-on-year increase and tripling the 2021 export value. This comprised 20.9% of China’s total li-ion battery export value, up by 3.5 percentage points from 2021. By the first quarter of 2024, this proportion had further increased to 22.0%.

Meanwhile, Chinese manufacturers are actively competing for the li-ion battery market in the United States. Since 2021, companies such as AESC, EVE Energy, and Gotion High-Tech have been accelerating their expansion into the US market by building battery gigafactories in the country. According to the Interact Analysis Global Li-Ion Battery Factory Tracker, Chinese li-ion battery manufacturers currently have planned battery capacity in the United States exceeding 150 GWh. While the world’s largest li-ion battery manufacturer, CATL, does not have its own manufacturing facility in the United States, it has been exploring the US market through partnerships with OEMs and technology licensing agreements.

For the US, China is vital for li-ion battery imports

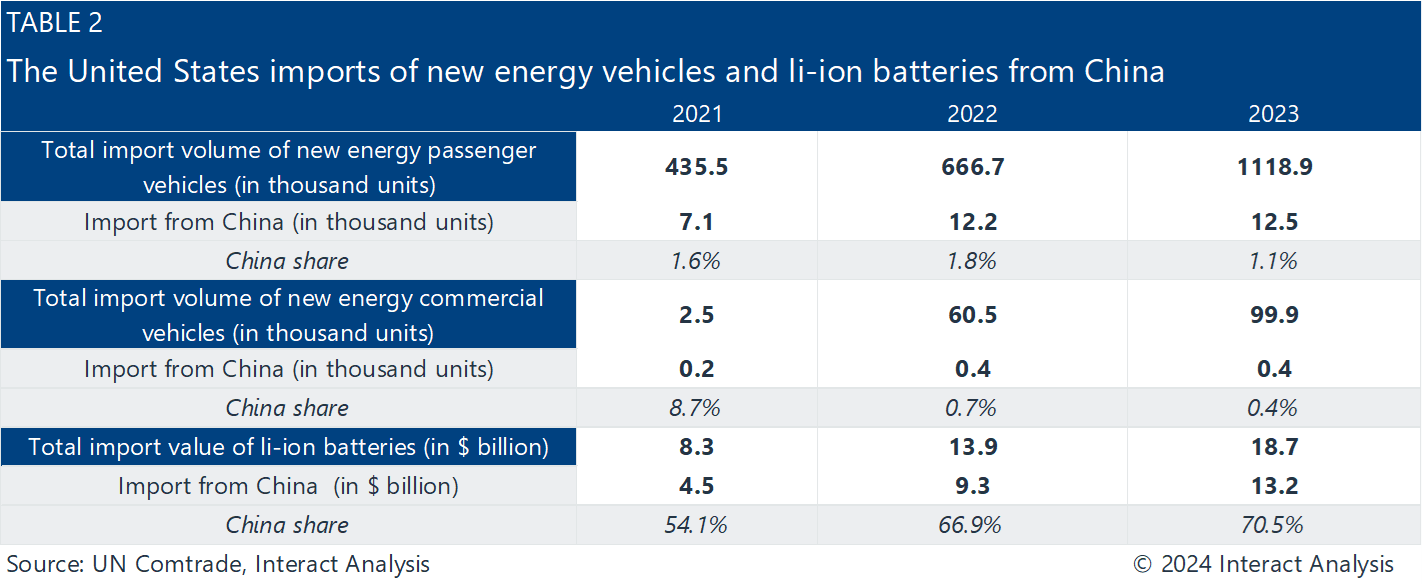

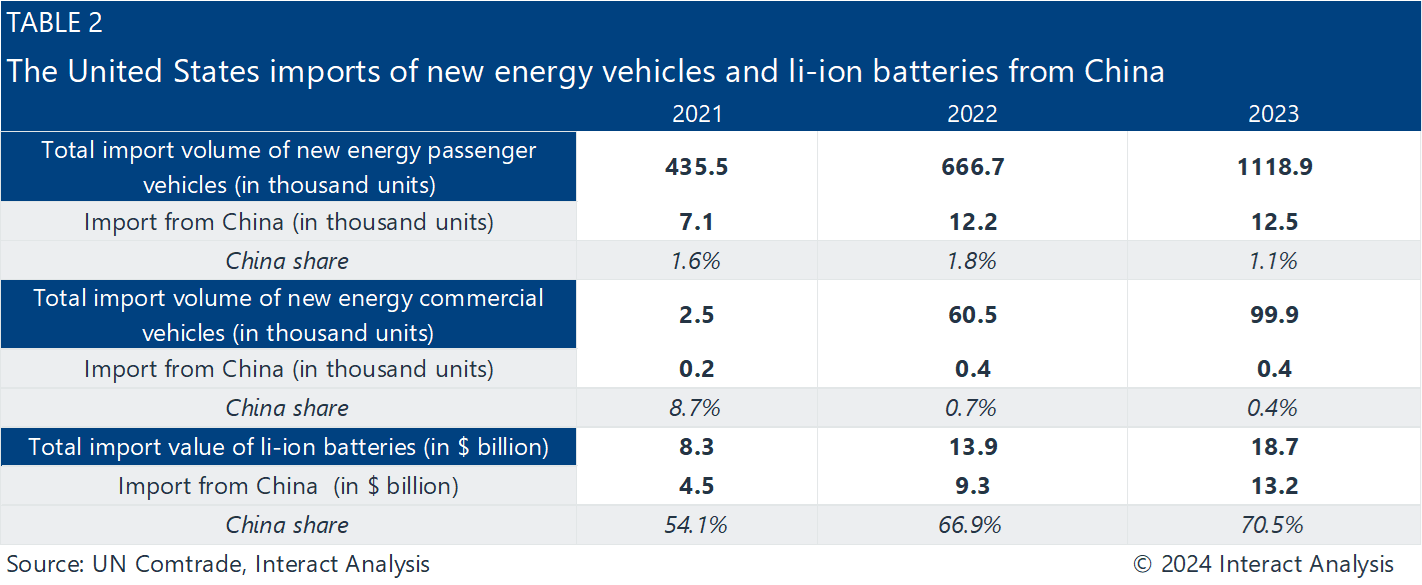

For new energy vehicles, China is not a significant source country for imports into the United States, accounting for only 0.4% of total imports. According to UN Comtrade, out of over 1.1 million new energy passenger vehicles imported into the United States in 2023, 75% came from South Korea, Japan, Germany, and Mexico. China contributed approximately 12,500 vehicles, or 1.1% of the total. As for new energy commercial vehicles, Mexico became the largest import source in 2022, contributing over 60% of imports into the US. Despite China ranking sixth in import sources in 2023, its share was only 0.4%, marking an 8.3 percentage point decline from 2021.

Since 2021, over half of the United States’ li-ion battery imports have originated from China. In 2023, the total import value of li-ion batteries into the United States reached almost $18.8 billion, marking a 34.9% increase compared with the previous year and more than doubling the import value in 2021. Among these, li-ion battery imports from China amounted to $13.2 billion, representing a 42.2% year-on-year increase and accounting for over 70% of the total.

In recent years, the U.S. government implemented a series of measures to support the development of domestic new energy supply chains. This has also attracted li-ion battery manufacturers from around the globe to establish factories in the US.

According to the Interact Analysis’ Global Li-Ion Battery Factory Tracker, over 30 battery projects (including new and expanded facilities) have been announced in the US since 2021, with planned capacity exceeding 920 GWh. However, considering the timeframe of 3-5 years for commencing production, the US remains highly dependent on imports in the short-term. For planned li-ion battery capacity in the US, Korean manufacturers are expected to contribute over 62.8% of new capacity, US local manufacturers account for 11.8%, and Chinese manufacturers for 14.3%. The US domestic li-ion battery landscape is likely change over the next 3 to 5 years.

Final insights

In the field of new energy vehicles, due to the relatively small trade volume between the two countries, the expected impact of this round of tariff increases on the new energy vehicle markets of both China and the United States could be insignificant.

In contrast, there is greater uncertainty surrounding the trade and future industry landscape of li-ion batteries between China and the United States.

For China, considering that North America is the third-largest region for Chinese li-ion battery exports (Asia and Europe are the top two, accounting for a combined 70.8% of export value in 2023), and the United States represents the largest market in North America, this round of tariff increases will undoubtedly directly impact China’s exports of li-ion batteries to the United States in the short term. However, Chinese li-ion battery manufacturers have been actively expanding overseas since 2022, establishing production bases in Europe, Southeast Asia, South Asia, and other regions. With the start of production at overseas facilities, China’s exports of li-ion batteries to the United States are expected to decline, with the impact of tariffs mitigated somewhat.

For the United States, although several domestic battery gigafactories are set to begin production, many of these facilities are joint ventures under the Inflation Reduction Act (IRA), involving partnerships between OEMs and overseas battery manufacturers. They are primarily aimed at targeted supply and may not have the capacity to respond to broader market demands. With the domestic battery industry chain still in its infancy, we anticipate the United States will continue to rely on overseas li-ion battery supplies in the short term. The tariff increases imposed on Chinese li-ion batteries may impact the prices of downstream electric vehicles in the United States, further slowing down the electrification process in the country.

Since 2021, over half of the United States’ li-ion battery imports have originated from China. In 2023, the total import value of li-ion batteries into the United States reached almost $18.8 billion, marking a 34.9% increase compared with the previous year and more than doubling the import value in 2021. Among these, li-ion battery imports from China amounted to $13.2 billion, representing a 42.2% year-on-year increase and accounting for over 70% of the total.

In recent years, the U.S. government implemented a series of measures to support the development of domestic new energy supply chains. This has also attracted li-ion battery manufacturers from around the globe to establish factories in the US.

According to the Interact Analysis’ Global Li-Ion Battery Factory Tracker, over 30 battery projects (including new and expanded facilities) have been announced in the US since 2021, with planned capacity exceeding 920 GWh. However, considering the timeframe of 3-5 years for commencing production, the US remains highly dependent on imports in the short-term. For planned li-ion battery capacity in the US, Korean manufacturers are expected to contribute over 62.8% of new capacity, US local manufacturers account for 11.8%, and Chinese manufacturers for 14.3%. The US domestic li-ion battery landscape is likely change over the next 3 to 5 years.

Final insights

In the field of new energy vehicles, due to the relatively small trade volume between the two countries, the expected impact of this round of tariff increases on the new energy vehicle markets of both China and the United States could be insignificant.

In contrast, there is greater uncertainty surrounding the trade and future industry landscape of li-ion batteries between China and the United States.

For China, considering that North America is the third-largest region for Chinese li-ion battery exports (Asia and Europe are the top two, accounting for a combined 70.8% of export value in 2023), and the United States represents the largest market in North America, this round of tariff increases will undoubtedly directly impact China’s exports of li-ion batteries to the United States in the short term. However, Chinese li-ion battery manufacturers have been actively expanding overseas since 2022, establishing production bases in Europe, Southeast Asia, South Asia, and other regions. With the start of production at overseas facilities, China’s exports of li-ion batteries to the United States are expected to decline, with the impact of tariffs mitigated somewhat.

For the United States, although several domestic battery gigafactories are set to begin production, many of these facilities are joint ventures under the Inflation Reduction Act (IRA), involving partnerships between OEMs and overseas battery manufacturers. They are primarily aimed at targeted supply and may not have the capacity to respond to broader market demands. With the domestic battery industry chain still in its infancy, we anticipate the United States will continue to rely on overseas li-ion battery supplies in the short term. The tariff increases imposed on Chinese li-ion batteries may impact the prices of downstream electric vehicles in the United States, further slowing down the electrification process in the country.