ZF goes out to ADAS Business in favour Harman

ZF Sells ADAS Business to In-Cabin Electronics manifacture Harman. According to ZF CEO Miedreich it's an important milestone for the strategic realignment of the ZF Group

ZF aligns with market trends and reshapes its automotive presence by divesting its Advanced Driver Assistance Systems (ADAS) business to US in-cabin electronics leader Harman International Inc. This will give Harman a highly sought-after combination of safety and vehicle interior technologies for automotive manufacturers worldwide. The enterprise value agreed upon is €1.5 billion.

ZF to trasfer ADAS business

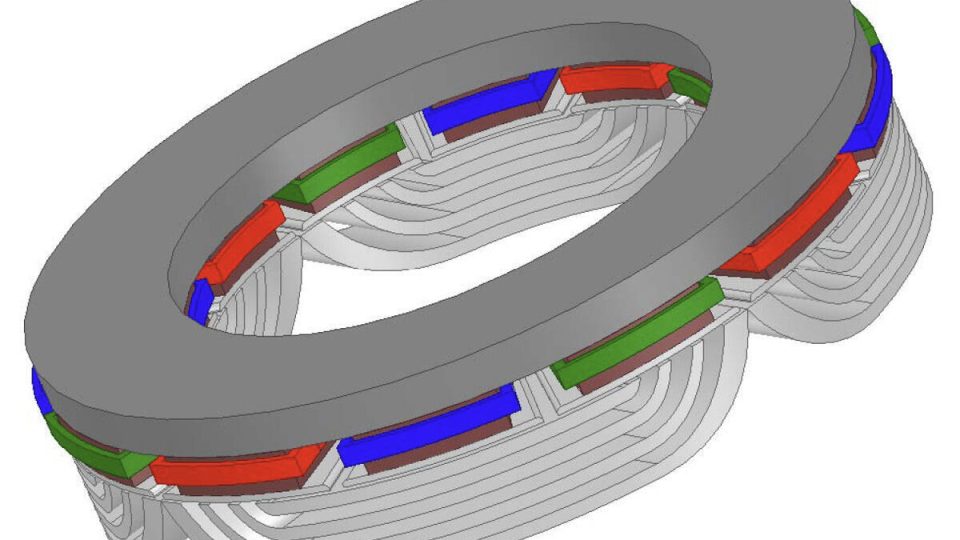

Under the agreement, ZF will transfer its ADAS business, including compute solutions, smart cameras, radar technology, and ADAS software functions, to Harman. The areas of electronics for chassis and passive safety technology will remain within the ZF Group. ZF will also continue its activities in the field of driver assistance and autonomous driving in the commercial vehicle sector.

The combined expertise of Harman and ZF’s ADAS business will enable the future organization to offer integrated or modular solutions tailored to different vehicle manufacturers’ strategies. It combines safety, perception, intelligence, connectivity, and in-vehicle systems into a comprehensive experience for drivers and passengers, positioning the company as one of the world’s leading providers of cross-domain automotive electronics.

Listening to the Harman’ CEO and the ZF’ CFO

“Our acquisition of ZF’s ADAS business is a strategic step forward for HARMAN to deliver on its promise to enable a more connected future of smarter and safer vehicles that are responsive to driver and passenger needs,” said Christian Sobottka, Chief Executive Officer and President, Automotive Division, Harman. “We look forward to welcoming the ZF ADAS team to the HARMAN family, where their talent and experience will play a key role in shaping the next chapter of the automotive industry’s transformation.“

“The proceeds from the sale will help to significantly reduce the ZF Group’s financial liabilities,“ said ZF CFO Michael Frick, assessing the impact of the transaction on ZF’s financial situation. “Proceeds from sales, combined with performance measures to increase organic cash generation, contribute to faster debt reduction. By focusing on core competencies and disciplined portfolio management, ZF is strengthening its competitiveness in the long term and creating room for profitable growth. Additionally, ZF – like other market participants – is restructuring its e-mobility business and rearranges unprofitable projects. We expect the adjusted EBIT margin and adjusted free cash flow for financial year 2025 to be in the upper half of the current forecast.“

Under the agreement, 3,750 ZF employees are expected to transfer to Harman upon completion of the transaction. The transaction is expected to close in the second half of 2026, subject to the necessary regulatory approvals.