Hydrogen buses: the time is now?

Technology in public transport has become a breeding ground for electrification. Will this also be the case for hydrogen?

Technology in public transport has become a breeding ground for electrification. Will this also be the case for hydrogen? Sustainable Bus magazine asked UITP, FCH JU, the German association of public transport companies VDV, the operators Transdev and Keolis and other industry stakeholders during the webinar “Hydrogen buses. Their time is… now?” (you can watch the full video here).

According to Efe Usanmaz, Manager Knowledge and Innovation Department at UITP, the international organization of public transport, in 2030 the 12 per cent of the city bus market in Europe will be covered by H2 buses. The JIVE 1 and JIVE 2 projects will end in 2021 with a total of 310 fuel cell buses rolled out in Europe (as of June 2021, there were some 150 hydrogen buses in operation) in 18 cities & regions across Europe by the end of 2022. Efe Usanmaz provided us some insights. When it comes to city bus market developments, BEBs are expected to take the lead; PHEB CNG/bio-gas to stabilize as transition technology; CNG/bio-gas has different market penetration across different markets. Finally, Fuel Cell Hydrogen Bus technology is consolidated as viable ZE solution, even to the amount of 12 buses out of 100, which we have just mentioned. Well, mass production is yet to be established. And costs is still an issue: a maximum price of €625k is the target of the above mentioned EU-backed projects.

As of October 2021, 17 cities and regions have been involved in JIVE and JIVE2 as they placed 274 bus orders from six different suppliers. Cologne and Wuppertal are taking the lead in Europe, with 70 hydrogen buses ordered so far. What is interesting, they are to be deployed on suburban routes.

It’s time for Fuel Cells and Hydrogen Joint Undertaking (FCH JU), a public private partnership supporting research, technological development and demonstration (RTD) activities in fuel cell and hydrogen energy technologies in Europe (with the European Commission among its member). Lionel Boillot, FCH JU project manager, updates data on the uptake of FBCs (Fuel Cells Buses) in Europe. Hydrogen buses within JIVE1 and JIVE2 projects have reached 15,000,000 km since projects started, more than 35,000 hours lifetime and 40.000km/year per bus on average. One of the most demanding challenges was reducing downtime. The most immediate solutions to achieve this goal have been to simplify access to spare parts, to integrate FC maintenance in bus preventative schedule and to focus dedicated pits at bus depots. Finally, a significant element is undoubtedly the presence of OEM staff on-site. Boillot tackles a hot topic, without which it is unthinkable to imagine hydrogen moving beyond the sphere of good intentions into practice and into applications that feed the vehicle fleet: business and financing models. Joint procurements, for instance, allow several cities to order plots of buses, renewing them from ten to ten according to budget availability. Another way is central purchase office, such as UGAP in France, where FCB are available on catalogue, and there is no need for a tender. Special Purpose Vehicle (SPV) gather all stakeholders (PTO, OEMs, H2 supplier, etc.) in order to share the investment risks.

Last but not least FCB leasing. These are measures to reduce the economic damage caused by the lack of a second-hand market. Basically it’s matter of CAPEX and uncertainties’reduction at end of the concession.

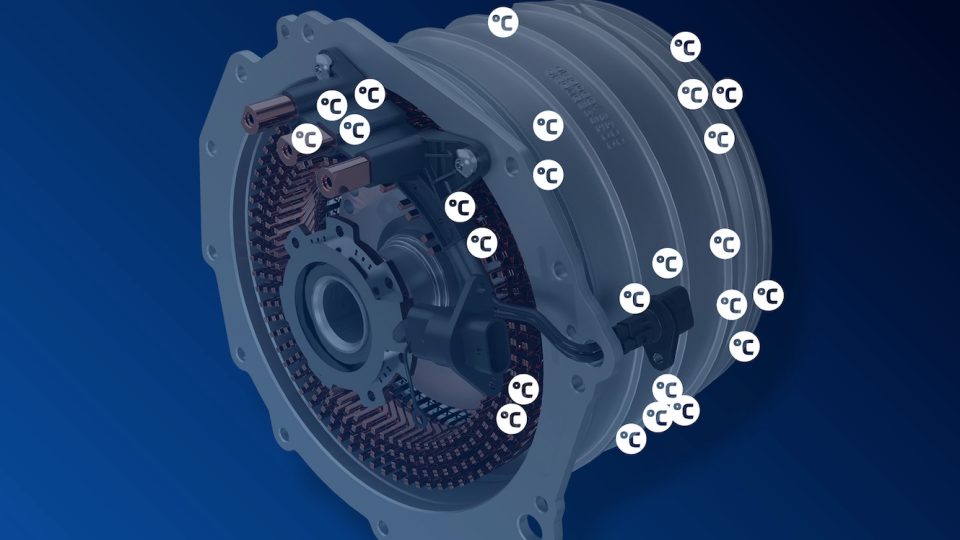

At the end, some pills of Project Genesis. The speaker is Bart Kraaijvanger, Manager Zero Emission Programs at Transdev Netherlands. The case study is the retrofit of an IVECO Crossway coach, equipped with a diesel engine, replaced by a hydrogen electric motor (via a fuel cell). The four steps of this project started at the beginning of 2021, with the completion of the technical, partnership and financial file. During the last year Q2 and Q3 the technical and administrative procedures to carry out the retrofit have been set. In Old Evreux, Normandy (France), started the refurbishment of the EAS-Hymob station, to improve the refuelling network and satisfy the basic needs of a successful initiative.