[Interact Analysis] Hydrogen ICE, some challenges to overcome

Hydrogen ICE technology is starting to see growth but needs to overcome market challenges to flourish, research by Interact Analysis reveals. Widescale adoption of H2 ICE vehicles remains some way off, with high fuel costs and infrastructure posing key obstacles.

The global hydrogen internal combustion engine (H2 ICE) industry is showing signs of growth but needs to overcome a series of key obstacles in order to see widescale adoption of vehicles, research by Interact Analysis reveals. The market intelligence specialist claims in its Hydrogen ICE – 2024 report the key obstacles preventing the sector from flourishing are the high cost of fuel and a shortage of adequate infrastructure to support market expansion.

Interact Analysis reports the sector is starting to expand, albeit slowly, and predicts the number of new H2 ICE vehicles registered annually will reach 13,150 in 2030, a small proportion of the million is vehicles sold each year, with a sharper increase to more than 100,000 a year by 2040.

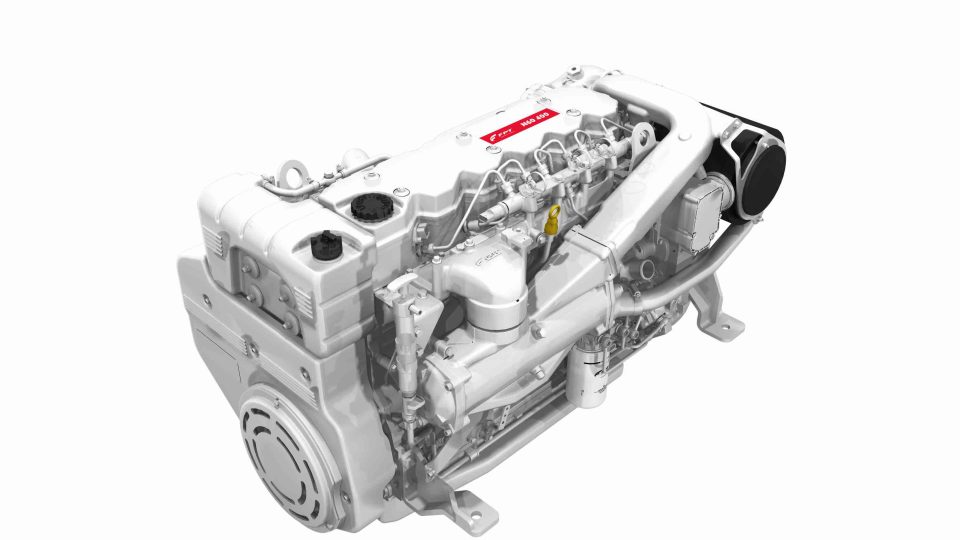

In addition to problems relating to the high cost of fuel and a lack of the infrastructure for the industry to flourish, there are a series of engineering challenges standing in the way of widespread uptake of hydrogen ICE vehicles. The most significant of these are precombustion (which affects port fuel engines in particular) and poor injector lifetime due to lack of lubrication, which at the present time stands at just over 1,000 hours.

However, the latest Interact Analysis report into the hydrogen ICE market, subtitled ‘An Assessment of the Opportunity for Hydrogen Internal Combustion Engine Technology in Transport Applications’, reveals experts believe major technological developments are possible or have already been achieved to address key engineering challenges. These include precombustion and poor injector lifetime, as well as others such as including leakages, embrittlement, and the need for engine redesigns. Indeed, there is a long-term target to bring the cost of an injector – which currently stands at about $1,000 – down as close to $100 as possible.

Jamie Fox, Interact Analysis Principal Analyst, says, “While H2 ICE appears to be in a strong position when it comes to overcoming technological and legislative obstacles to success, the market challenges it faces are more difficult, particularly the high cost of fuel. Because of the lower efficiency for trucks and buses, the cost per mile for H2 ICE is even higher than it is for fuel cells, while the cost varies by application for off-road machines. This is coupled with additional problems relating to the cost and availability of necessary infrastructure. We are some way off full commercialization of the industry and we expect total cost of ownership for hydrogen ICE to remain higher than diesel battery electric vehicles out to 2035 and beyond. Our H2 ICE – 2024 report contains full details of our projections and the obstacles preventing widespread adoption of hydrogen ICE commercial vehicles.”