[Interact Analysis] Should hydrogen engine manufacturers target off-road or on-road?

In this insight, Jamie Fox, Principal Analyst at Interact Analysis, discusses whether hydrogen engine manufacturers should focus more on off-road or on-road transportation.

Hydrogen internal combustion engine (H2 ICE) vehicles became a hot topic last year. By now, most suppliers and OEMs have evaluated this space and, if they have decided to participate, have a strategy in place or will soon. Hydrogen ICE has many possible target markets. But none of these are going to see significant volume in 2023. It remains unclear what the top market will be.

This insight will try to answer that question, but first it’s worth stopping a minute to consider what we mean by hydrogen engine vehicles. We are not talking about most hydrogen vehicles produced today which use fuel cells, which are a completely different technology. Instead, we are talking about a combustion engine that is broadly similar to a petrol or diesel engine but burns hydrogen instead. Advantages of hydrogen ICE include the ability to use existing production facilities, a reasonable up-front vehicle cost and high power and energy density. Disadvantages including high running cost (at least at current hydrogen prices), the need for refuelling infrastructure and the fact that the engines do produce some NOx emissions (although not much).

So, where will hydrogen engine vehicles add value – on-road or off road? And where should makers of engines, injectors, and other components focus?

Some manufacturers are targeting trucks

Let’s start with on-road. Hardly anyone is seriously looking at buses for H2 ICE, so by on-road I really mean trucks. It will be difficult in many applications to compete with battery electric vehicles (BEV), which are less expensive in total cost of ownership. Given the cost of hydrogen and the low efficiency of engines, the total lifetime cost of BEV could be half or a third of a H2 ICE vehicle in some cases! But you have to look at the specific use case. For vehicles doing over 200 miles day after day the running cost of H2 ICE may be too high. But for a vehicle that does a smaller distance each day but very occasionally goes a much longer distance, H2 ICE vehicles can make the math work. And that occasional longer distance might be a problem for a BEV vehicle. So, H2 ICE may be able to find a niche.

On-road is a market than is moving to and considering alternative powertrains a little faster than off-road. So that may be an advantage for any non-diesel technology.

Off-road might be a more natural fit, but volumes are lower

Off-road is a different case. The total market size is smaller, and not only that, it’s segmented into many different types of machinery, each with its own challenges. But the off-road market can offer something for hydrogen that the on-road market can’t: less competition from BEV. BEV certainly can and is used in off-highway, especially in smaller vehicles such as forklifts.

However, some other off-highway vehicles are very hard to electrify. Large, heavy vehicles that need huge batteries are considered fundamentally challenging for electrification and each machine needs a different new design for BEV powertrains due to different sizes and duty cycles. Engine manufacturing capability and expertise, by contrast, already exists for a wide range of machines. It would be slightly exaggerating to say that with hydrogen ICE you only need to change out for a different engine type and add some tanks. But it’s not so far from the truth.

It’s not just that either – perhaps an even bigger issue is when you have machines that you are using many hours a day, which can happen for tractors and excavators. How do you deal with a 15-hour day of almost continuous work if the battery will be flat in 3 hours? In these types of situations, hydrogen vehicles have a chance to get in the game. Fuel cell vehicles will be considered also here. But the lower CAPEX and better resistance to fuel impurities, and dirt and dust in operation, may make H2 ICE more appealing off road.

Hydrogen fuel takes up a lot of space in a vehicle. As well as weight. In off-road environments, it will often, unlike on-road not be necessary to carry all the fuel for a day’s work on the vehicle making the vehicle design easier.

But volumes still matter

So, the use case seems arguably better off-road. More advantages overall. But it’s not that simple. Once you have designed an on-road truck, you can sell the same truck to many different companies for different applications. In off-road, you are having to produce a new vehicle for each different application. If one truck can unlock a huge market, with much higher shipments than ever possible for a single vehicle in off-road, then manufacturers will still lean that way if they can make it work.

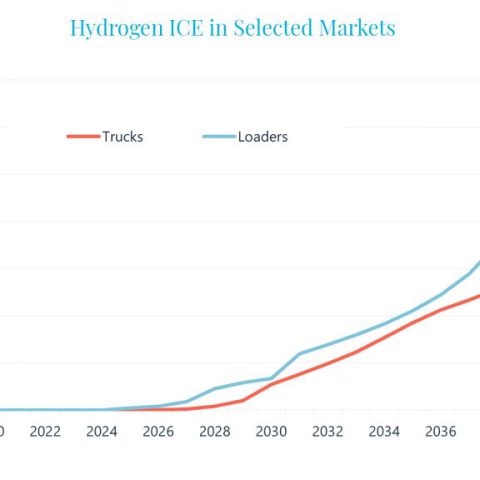

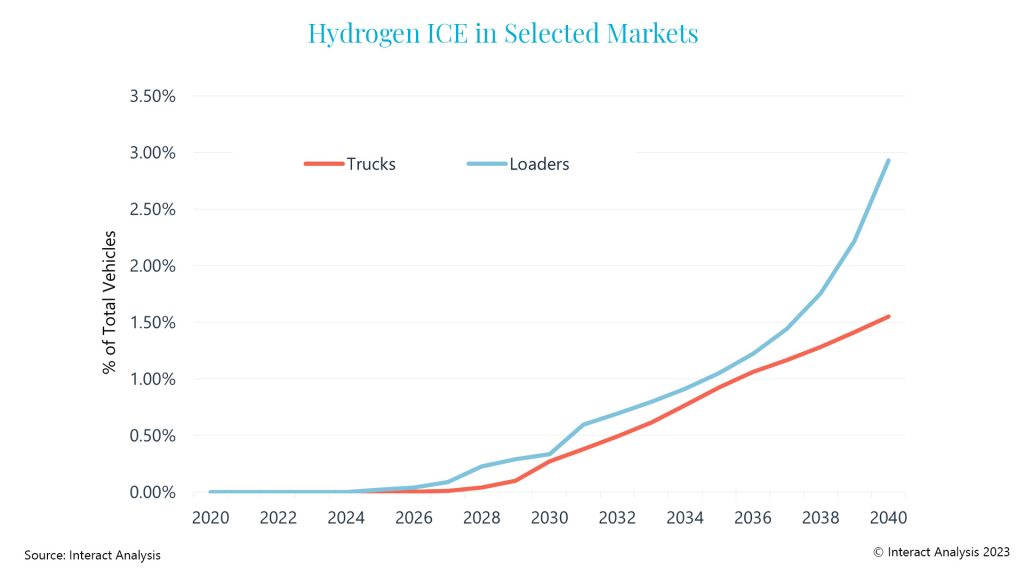

Interact Analysis has forecasted higher volumes for on-road than off-road. But it’s worth noting that this is the median case. The bear scenario for H2 ICE in on-road is worse than off-road. In a pessimistic case, it’s plausible to imagine a world with a high hydrogen price, battery prices crashing as capacity builds up, and no support for hydrogen from regulators. In such a world, the number of H2 vehicles on-road could be closer to zero than the forecast in our report. However, H2 ICE would still even then be able to find a niche in off-road in areas where diesels are being phased out and BEV just can’t get the job done.

Conclusion

The case for H2 ICE in trucks is certainly not a slam dunk. It’s challenging. To me, BEV makes more sense in most cases… but you only need to find one or two decision makers that have decided that they want to diversify rather than put all their eggs in the same basket. If you can find these people and they work for big enough customers, you can get a business going.

So, what’s our recommendation? I think engine and component manufacturers should engage closely with truck manufacturers. Make sure that they have skin in the game and are willing to make real commitments – signed deals. If they are, then I would focus on this market because that’s where the biggest volume is in theory. But throwing a lot of investment at hydrogen for trucks without commitments from anyone looks too risky. If you can’t get the commitments, don’t be distracted by the false promise of a huge truck market – it may not happen. Stick to off-road where volumes are lower but prices and perhaps margins on components can be higher. And there are more cases where BEV can’t deliver.