Rolls-Royce Power Systems records very good results

Rolls-Royce’s Power Systems business unit – with its key mtu brand – saw revenue, profit and cash flow rise strongly in 2023 to reach very good results. Revenue was primarily driven by energy systems, especially for data centres.

Rolls-Royce’s Power Systems business unit – with its key mtu brand – saw revenue, profit and cash flow rise strongly in 2023 to reach very good results. Revenue was up 16% at EUR 4.56 bn (£ 3.97 bn) with underlying operating profit improving 44% to EUR 474 million (£ 413 million), giving a margin of 10.4% (2022: 8.4%). Revenue was primarily driven by energy systems, especially for data centres. Pricing and cost management measures produced a higher margin for the year as a whole and, in particular, higher profits in the second half of the year.

“We are in a position of strength. Our core business is doing well, and we’re extremely well positioned in our markets. We’re seeing growth potential in nearly all our markets, largely independent of global economic developments,” said Jörg Stratmann, CEO of Rolls-Royce Power Systems. “Our transformation with its strong focus on high-margin business and profit, is paying off.”

Order intake at Power Systems came to EUR 4.99 bn (£ 4.34 bn), putting Power Systems on a par with the previous year, giving a book-to-bill ratio of 1.1 and order coverage for new products of around 80% in 2024. Demand was especially strong in power generation, marine and governmental business. Cash flow from operating activities was EUR 530 million (£ 461 million) with a cash conversion rate of 112% following EUR 185 million (£ 158 million) and 56% in the previous year.

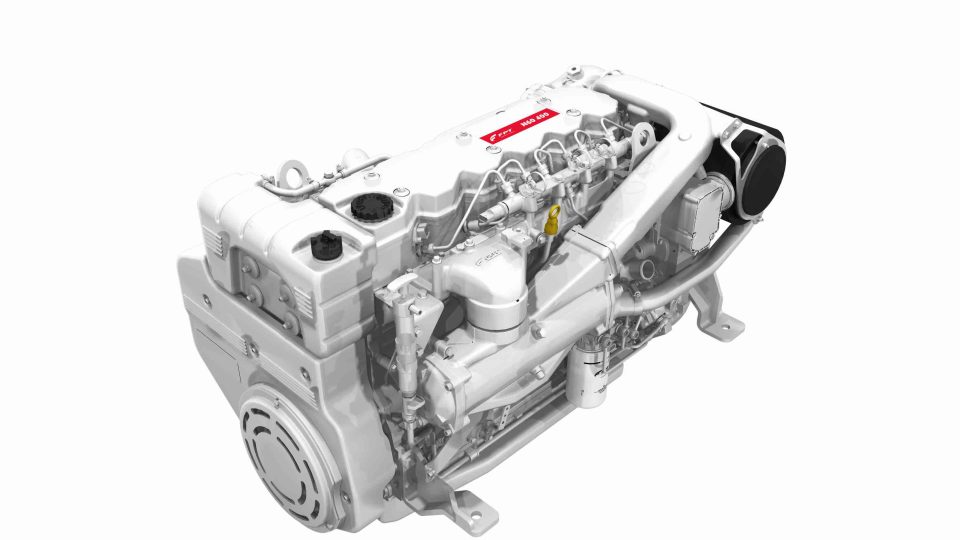

The increase in adjusted operating profit was due to commercial optimisation and strict management of costs. A major improvement in earnings was achieved – above all in the energy systems business, primarily with mtu standby power systems for data centres. The improvement in the operating margin was achieved despite some negative impact from a shift in the product mix. Significant developments in the past year include the commissioning of one of the largest battery and energy storage systems in Europe, which is helping integrate renewable energies into the Dutch public grid, and implementation of the ‘From Bridge to Propeller’ strategy for large yachts with the acquisition of yacht automation and bridge manufacturer Team Italia Marine.

“Our consistent focus on markets where we can be particularly successful will remain our strategy in the years ahead,” said Jörg Stratmann. “We’re focussing on five strategic initiatives: power generation, governmental business, marine, battery storage, and service. Another special highlight is our first investment in 20 years in developing a new mtu engine platform. It will enable us to offer customers a wider performance range, and will give us a foundation for further developments in combustion engines using alternative fuels.”