Agco, the group’s strategies in an interview with CEO Eric Hansotia

On the occasion of the international event organized for the presentation of the new Fendt 700 Vario, our colleagues from Trattori spoke to the CEO of the Agco Group about financial results, strategies for the three tractor brands and much more.

After the excellent results of 2021, AGCO also found itself facing the consequences of the Ukrainian crisis and the shortage of raw materials which, even today, after more than two years, afflicts all global supply chains. How did the Group react to these problems and what strategies did it implement?

Unfortunately, that of raw materials is still a burning issue for us, with which we are forced to deal daily since the outbreak of the pandemic. Our aftermarket team is doing a great job in researching the materials necessary for the construction of spare parts which are then supplied with absolute priority to our customers who already own Agco group machinery and who need them for urgent repairs. The effectiveness of this strategy is demonstrated by the market shares we have gained, one of the most reliable indices to understand the trend of the situation. Furthermore, the outlook for the second half of 2022 is much better, and we expect the problem to solve in the next year.

AGCO, the strategies for 2022

What are the objectives for the end of 2022 and for the first months of next year?

Our agenda is full. Orders have arrived at our sales office and we are doing everything possible to be able to produce as many tractors and agricultural machinery as possible for our customers by next spring. We are also returning from two excellent financial quarters which will materialize in a record third and fourth quarter for the AGCO Group, with over 12.5 billion in turnover. Based on the performance of our factories, we should be able to fulfill all orders in the coming months.

What impact did AGCO’s cyber attack in the United States last spring have on your production?

We actually suffered a major attack last May by a group of hackers linked to Russia’s cyber military division, so the effect was quite severe. Our IT systems have been out of use for more than two weeks (with different times based on the different areas of the world where our company is present). This meant that our second quarter production hours decreased by about 8% compared to the second quarter of 2021, resulting in a reduction in sales in the quarter compared to our original targets. However, we expect to close the gap by increasing production in both the third and fourth quarters. Now all of our plants and offices are fully operational. We have learned a lot from the attack and have enhanced the cybersecurity of all our infrastructures and are therefore ready to manage any other problems of this type.

Fendt, Massey Ferguson, Valtra: the role of brand

Speaking more specifically of the individual brands, regarding Fendt, which is the best performing brand in Europe, are you going to upgrade the product lines for all ranges?

Surely. At a strategic level, Fendt has two main directives: on the one hand, the focus is on the product, we are trying to complete the ranges of our agricultural machinery, from sprayers to new tractors, without forgetting combines. The other push is that aimed at making the brand more global, making it arrive decisively in Africa and Oceania and trying to double the turnover in these markets within the next five years.

Specifically, what are the plans to expand the Fendt business in North and South America?

Our intent is to gradually arrive in these two markets, through a strategy that will reward the best dealers through a tight system of analysis. Our Fendt brand sales in the first half of 2022 increased by more than 20% compared to the first half of 2021. And we expect these growth rates to further improve in the second half based on our current production plan. Sales of Fendt and Challenger in North and South America are expected to double in 2022 compared to 2020, with the ambitious goal of doubling them again in the next five or seven years.

Massey Ferguson and Valtra chapter: does AGCO intend to maintain a separate strategy for the development of the two brands or, as has already happened for other competitors, will it bring together production globally in specific poles, then differentiating only the liveries and the name?

For each of our brands we have completely different development and positioning strategies. The machinery, technologies and target audience of the various brands are completely different. The intention is therefore to maintain differentiation at both the product and marketing level. Massey Ferguson and Fendt are global brands, with Fendt targeting large premium customers and Massey Ferguson focusing on all customer segments. Valtra, on the other hand, is mainly present in Europe and South America and its vocation is linked to territories in which there are complex climatic and geomorphological conditions (such as in the tropics or in the case of forest applications).

How much does AGCO invest in Research & Development and what is your strategy regarding precision agriculture and smart technologies?

Our investments in R&D have grown by millions of dollars year on year and the goal is to continue on this path, with an eye to our specialists and to the engineering side of production. At the same time, on the side of smart and precision technologies, last year we acquired six specialized companies and this year invested in two more. Thanks to the excellent reception that our products are receiving from our customers since 2018 we have achieved an annual growth rate of over 20% in our Precision Ag business. By virtue of this performance we are aiming for a turnover of over 900 million dollars from our Precision Ag portfolio by 2025.

How are you moving in the field of sustainability and what role will this aspect play in future strategies?

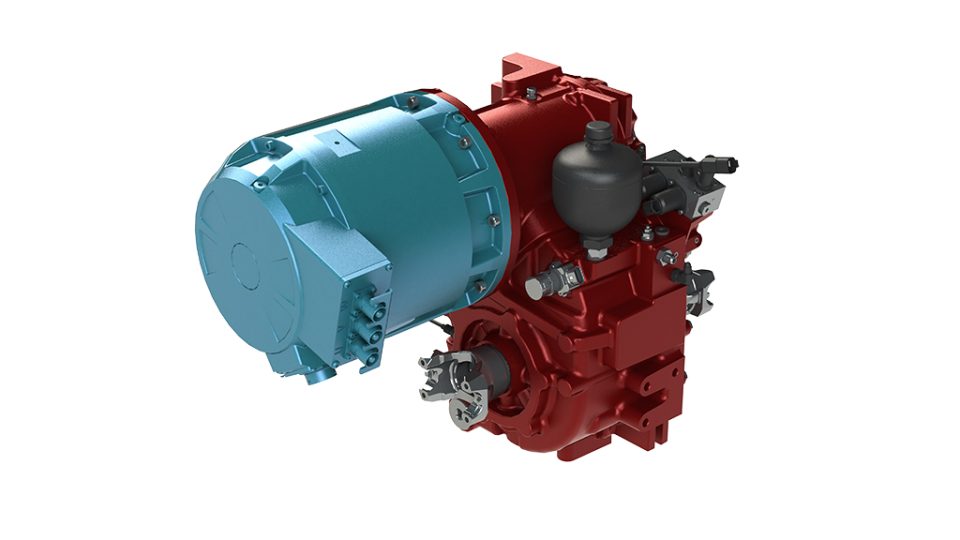

For us this is a fundamental aspect. First of all, we took action at the level of production poles, trying to emit as little CO2 as possible from our business processes. The intention, on a global level, is to be able to achieve climate neutrality at least 60% of our production plants. On the other hand, also from a product point of view, we are developing low-emission tractors and machinery, including electric and hydrogen (part of the H2 Agrar program). The third part of these strategies is aimed directly at farmers and their training, to reduce emissions and improve soil treatment. Finally, on the product side, I would like to remind you that hydrogen solutions will be applied to high-powered tractors, hybrid ones to mid-range tractors and electric ones to less powerful tractors (as is already happening for the Fendt e100 Vario).