Forklifts Trend. According to Interact analysis

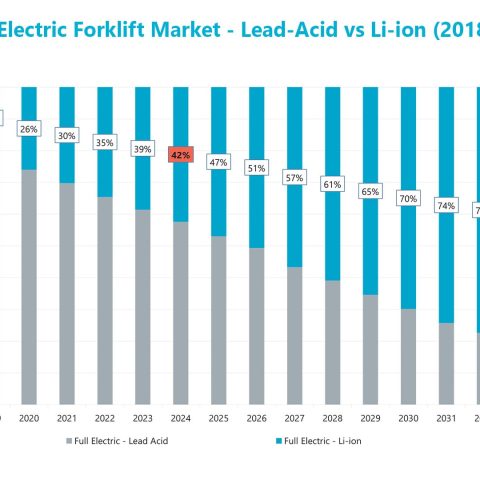

According to Interact Analysis, Li-ion forklifts are raising and projects penetration rates will soar from approximately 32% in 2024 to over 70% by 2034 within the full-electric sector (which includes Li-ion and Lead-Acid models)

Forklifts are pioneering applications in electrification, not only within the lifting sector but across the broader NRMM galaxy. We present an analysis of this application’s evolution, transitioning from lead-acid batteries to align with global trends, provided by Interact Analysis. Electrification is one of the most transformative and irreversible trends in the forklifts market. The systemic shift from internal combustion engines (ICE) to electric powertrains, predominantly lithium-ion (Li-ion) batteries, is fundamentally reshaping the industry’s competitive dynamics, operational protocols, and environmental impact.

Interact Analysis Forklifts – 2025 Report

Our recently published Forklifts – 2025 report charts the meteoric rise of Li-ion forklifts and projects penetration rates will soar from approximately 32% in 2024 to over 70% by 2034 within the full-electric sector (which includes Li-ion and Lead-Acid models). A pivotal industry inflection point is expected around 2026, when Li-ion technology is forecast to surpass lead-acid batteries in market share within the electric forklift segment.

By 2034, a staggering 83% of all new electric forklifts shipped globally will be powered by Li-ion batteries. This rapid transition is overwhelmingly driven by the compelling operational and economic advantages of Li-ion technology. These include opportunity charging (1-2 hours versus 6-8 hours for lead-acid), a significantly longer lifespan (5-7 years versus 2-3 years for lead-acid in high-use applications), minimal maintenance (no watering, equalizing charges, or dedicated charging rooms), and a demonstrably lower Total Cost of Ownership (TCO), despite a higher initial investment.

The trajectory of electrification is varies widely across geographical regions, reflecting differing economic structures, regulatory pressures, and market maturity.

China

China is the primary engine of global Li-ion penetration. Its Li-ion forklift shipments are projected to explode from 26,436 units in 2018 to over 1 million units annually by 2034 – a more than 40-fold increase. This dominance is heavily fueled by the mass production and adoption of cost-competitive Class 3.1 electric warehouse forklifts, with prices for basic models falling to around $1,000. By 2034, over 73% of forklifts sold in China will be Li-ion battery-powered.

Europe

Europe is advancing rapidly, driven by stringent emissions standards (like EU Stage V) and strong corporate ESG mandates. Key European markets, including France, Germany, Italy, and Spain, had targeted a 50% Li-ion penetration rate for all forklift classes by 2025.The UK and Sweden are close behind and are expected to reach this milestone by 2027.

North America

North America lags significantly behind China and Europe, with the US not expected to reach 50% Li-ion penetration until 2032. This delay is attributed to entrenched structural barriers. These include the widespread use of Class 4/5 ICE cushion-tire models in specific applications like rear-loading trailers, deeply established service ecosystems for ICE equipment, and a large installed base that encourages maintaining the status quo.

The shift towards electric forklifts is driven by a powerful combination of factors, including:

- Intensifying regulatory pressure: Tightening emissions standards and the introduction of carbon tax mechanisms are systematically eroding the economic viability of ICE forklifts.

- Compelling operational & TCO advantages: Electric forklifts, particularly Li-ion models, substantially lower maintenance costs and reduce unplanned downtime. They also deliver superior energy efficiency and zero emissions at the point of use, which are critical for indoor air quality.

- Corporate ESG commitments: Large multinational corporations are increasingly integrating fleet electrification into their broader sustainability roadmaps to meet decarbonization targets and enhance their corporate social responsibility (CSR) profiles.

- Expanding secondary market: A growing and reliable secondary market for used electric forklifts is making the technology accessible to small and medium-sized enterprises (SMEs). SMEs have been priced out of the new equipment market previously, so access to affordable equipment is broadening adoption.

Persistent challenges and barriers to adoption

Despite the clear growth trajectory for electrified forklifts, the transition from ICE and lead-acid machines faces significant headwinds, such as:

- High upfront capital outlay: The initial investment for Li-ion forklifts and the requisite charging infrastructure remains a primary barrier, especially for budget-conscious SMEs.

- Complex infrastructure requirements: The most critical customer friction point is electrical infrastructure. Data indicates that 50-60% of charging installations require facility upgrades, which can add up to 25% to the total project cost. Steps like grid connection evaluation, warehouse electrical layout design, and charger installation are rated as high in both complexity and cost.

- Supply chain and expertise gaps: While improving, the supply chain and after-sales market for Li-ion components are not yet as mature as those for ICE or lead-acid technologies.

Future development directions of electrification

Looking ahead, breakthroughs in industry will stem from two parallel paths:

- The first is the continuous evolution of technology pathways. Solid-state batteries promise to achieve a leap in performance, while sodium-ion batteries are positioned to create differentiated segments in specific market niches. Together, they will broaden the application boundaries of electrification.

- The second is the fundamental restructuring of business models, shifting from selling products to providing “full-value-chain solutions.” The integrated design and delivery of forklifts, batteries, charging piles, and infrastructure support significantly lower barriers to adoption and reduce costs for customers. For manufacturers, the ability to successfully build integrated service capabilities will be central to establishing a competitive advantage in the post-lithium battery era.

Final thoughts

Forklift electrification has passed the tipping point, evolving from a forward-looking trend into a core strategy that determines future enterprise competitiveness. Proactive leaders who actively adopt electrification are leveraging significant operational cost advantages, enhanced sustainability credentials, and superior supply chain resilience. In contrast, enterprises that lag behind in this transition may face the dual pressures of cost disadvantages and technological misalignment. As battery technology continues to advance, lifecycle cost advantages increase, and charging infrastructure becomes more refined, electric forklifts are rapidly transitioning from a “preferred option” to the “default configuration” in global industrial and logistics sectors, redefining the future landscape of material handling.