[Interact Analysis] Challenging 2024 for US construction industry

The US construction industry is facing a tough year, but the sector is forecast to show signs of growth in 2025. With the US Infrastructure Bill supporting construction investment and inflation expected to fall over the next couple of years, there are encouraging signs for a 2025 bounce back. Read the full insight by Alexander Jones, Data Analyst at Interact Analysis.

The US construction industry is facing a tougher year in 2024 when compared with the previous two, but the sector is forecast to show signs of growth in 2025, as economic conditions improve. Both the residential and non-residential sectors are experiencing constraints on spending, with some sectors and states bucking the trend. This is leading to caution when it comes to investment in construction machinery, which is expected to cause a dip in order books and may be leading to an increase in rental/leasing activity. With the US Infrastructure Bill supporting construction investment and inflation expected to fall over the next couple of years, leading to a decrease in short-term interest rates, there are encouraging signs for a bounce back in 2025. This insight provides an analysis of the current situation and outlook for the US construction industry and the construction machinery sector.

The US economy

Looking at the US economy in general, there are signs for optimism in the near future. The US Bureau of Economic Analysis (BEA) estimates GDP increased by 1.6% in Q1 2024 versus the previous quarter, driven by higher-than-expected levels of consumer spending (primarily in the services rather than goods sector), although it is likely growth rates will come down over the course of this year, in line with the global economy.

According to the OECD, short-term interest rates are set to decrease gradually over the next couple of years, from 5.4% in Q1 2024 to 4.0% by Q4 2025. However, they are still much higher than before the Covid-19 pandemic and banks will be reluctant to decrease rates too drastically while inflation is still high. Nonetheless, it looks as though inflation is starting to come under control; currently sitting at 3.0% and projected to fall to 2.1% by the end of 2025. Perhaps the potential for a de-escalation of conflict in the Middle East and Ukraine is behind these projections, as it is currently unclear what impact November’s US election results will have on the wider economy.

The residential sector

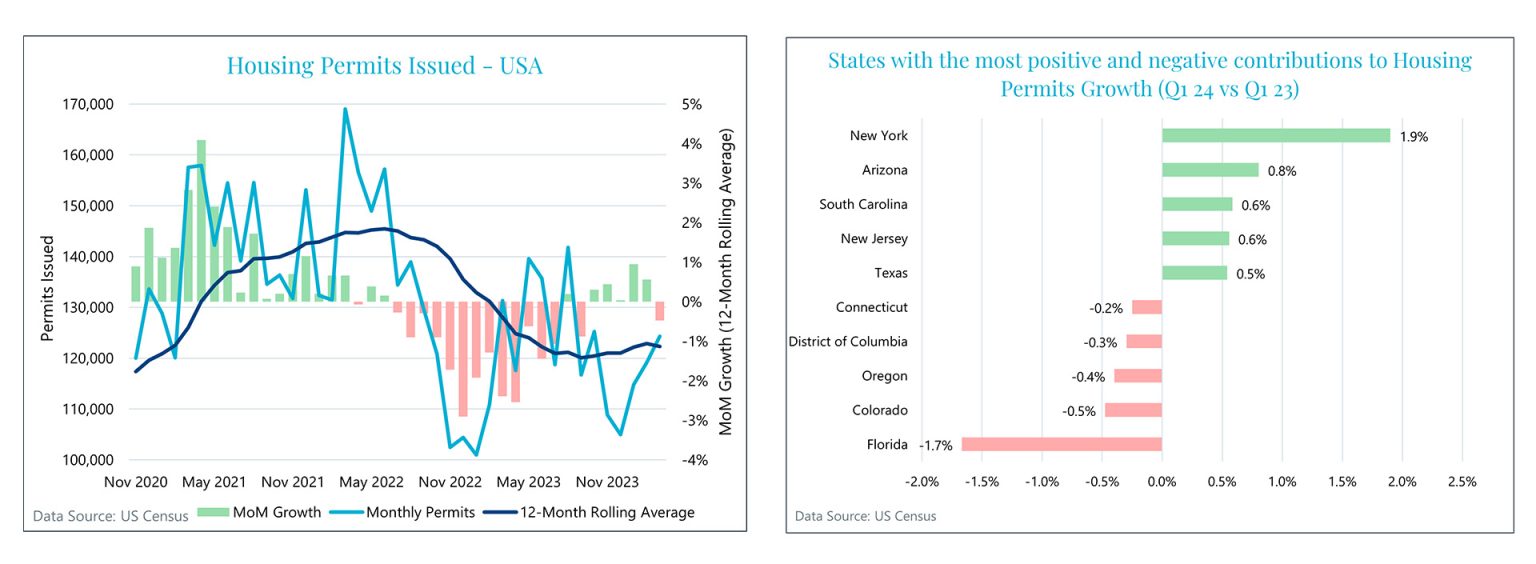

Monthly housing permits data is a good short-term indicator of the state of the residential construction market. According to the US Census, in Q1 2024 358,000 housing permits were issued in the US, versus 343,000 in Q1 2023 – an increase of 4.4% year-on-year. Therefore, it looks like there is still some growing demand for house-building construction work. However, examining the 12-month rolling average, there is a 0.47% decrease in permits issued in March 2024 versus the previous month (although growth was positive for the preceding 5 months). Despite some positive indicators, there is still a long way to go to reach the highs of 2022 (Q2 2022 saw 463,000 permits issued). The US has passed through the post-Covid housing bump and now the market doesn’t look particularly strong compared with a year or two ago. It is likely the housing market will be flat this year or even slightly worse off compared with 2023, with high interest rates continuing to constrain activity.

Of course, the picture is different depending on where in the US you are, with some states faring better than others. At a state-level, the top 5 contributors to the growth seen in Q1 2024 (versus Q1 2023) were New York (+1.9%), Arizona (+0.8%), South Carolina (+0.6%), New Jersey (+0.6%) and Texas (+0.5%). Meanwhile, the 5 states with the highest negative contributions were Florida (-1.7%), Colorado (-0.5%), Oregon (-0.4%), DC (-0.3%) and Connecticut (-0.2%). If you are a construction equipment manufacturer or dealer, focusing your efforts in the former regions is more likely to maximize sales this year.

The non-residential sector

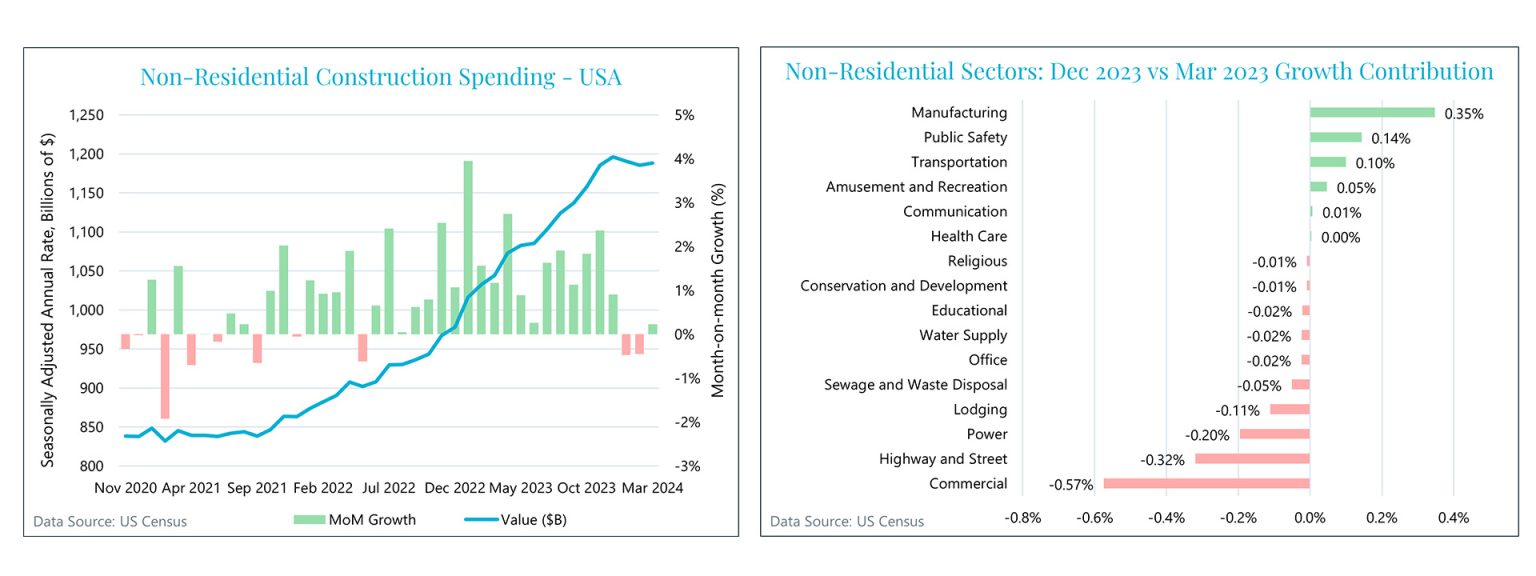

The value of the non-residential construction sector declined in the past few months. In March 2024, the total value of non-residential construction work done in the U.S was estimated to be $1.19 trillion (seasonally adjusted annual rate) – a 0.2% increase on the previous month, and a 13.7% increase on the same month last year. However, construction spending has decreased in two out of the past three months, down slightly from December 2023 ($1.20 trillion). Looking at year-over-year comparisons, growth rates have been coming down for the past five months, from a peak value of +22.8% in October 2023. Nonetheless, spending is still at record-high levels compared with previous years. It may have topped out (for now), but spending is certainly still happening, backed up by funding from the Infrastructure Bill. There are currently no signs of a more dramatic drop in spending, as we would expect on the brink of a recession.

Breaking the spending down by sector reveals that not all industries are behaving in the same way. The chart below shows which sectors are contributing positively to the overall growth, and which are contributing negatively. From December 2023 to March 2024, non-residential construction spending decreased by 0.69%, with manufacturing having the most positive contribution (+0.35%), while commercial construction had the most negative contribution (-0.57%). Strength in manufacturing is being supported by growth in the electronics sector, which is a result of investment generated by the CHIPS act. Weakness in the commercial sector is understandable, as a large proportion of it comprises warehousing and retail – both of which are underperforming.

Impact on the construction machinery market

So what does this all mean for the construction equipment market?

· Caterpillar recently announced its Q1 2024 financial results, stating a 0.4% drop in revenue when compared with Q1 2023. The company is expecting sales for the total year to be about the same as 2023, and attribute the lack of growth to lower sales volumes combined with general price increases. Volvo Construction announced a revenue decrease of 8.9% YoY, although the number of vehicles delivered was largely unchanged.

· Meanwhile, United Rentals, the world’s largest equipment rental company, posted an increase in revenue of 6.1% year-on-year in Q1 2024, and a similar level of growth is expected for the whole year. When the economy is tough, companies turn to renting/leasing construction equipment rather than purchasing. Contractors may choose to defer buying equipment, making them more likely to rent. This could explain why United Rentals are performing well relative to the two construction equipment manufacturers mentioned, although there may be other factors specific to United Rentals at work.

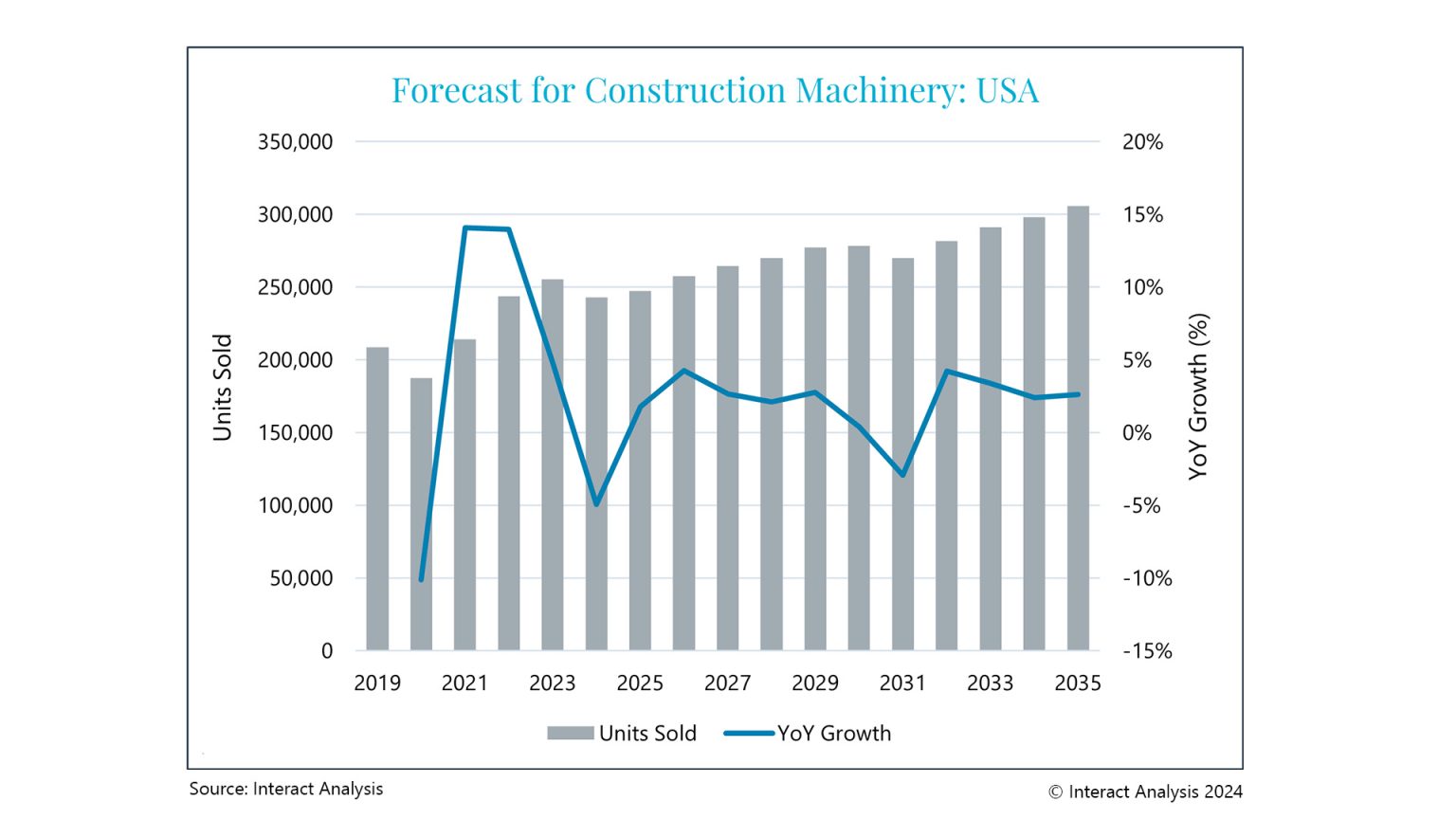

· A slowdown in the US construction industry means equipment manufacturers will see a drop in their order books. According to the latest edition of Interact Analysis’s Off-Highway Vehicles Market Study, the construction machinery market (in unit terms) is expected to drop by around 5% in 2024 versus 2023, with over 240,000 vehicles expected to be sold (see chart below).

· Beyond 2024, we anticipate a bounce-back in sales, with 247,000 units projected to be sold in 2025 – a year-on-year increase of 1.8%. In 2025, interest rates will (hopefully) be lower, and inflation more under control. As a result, we are likely to see improving economic conditions. The current trajectory is for more favourable growth for construction projects and, as a result, higher sales of construction equipment. The Infrastructure Bill is currently supported by all parties and won’t be going away anytime soon, regardless of the outcome of the next election.