Off-Highway and tariffs, according to Interact Analysis

Tariffs are causing uncertainty, affecting both supply and demand for off-highway vehicles in the short term

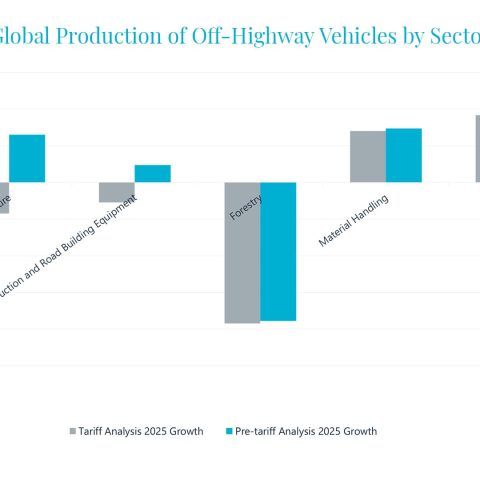

According to Interact Analysis, the threat of tariffs is causing uncertainty for the global off-highway vehicles market. The long-term outlook for the global off-highway vehicles market is strong and a return to more robust growth is forecast from 2026.

Uncertainty is the main damage caused by tariffs to off-highway OEMs

However, the market intelligence specialist warns that tariffs – led by the US government’s current trade policies – are causing uncertainty, affecting both supply and demand for off-highway vehicles in the short term.

A THOUGHT ABOUT EXCAVATORS AND COMPONENTS (IN 2023)

Following a challenging year for the off-highway vehicles industry in 2024, Interact Analysis predicts the market will continue to struggle in 2025, with recovery of global sales now anticipated in 2026. It notes that the return to a strong growth trajectory is likely to be driven by a trio of mega trends: labor shortages; infrastructure demand; and feeding the expanding global population. Falling demand in the US for construction and agricultural machinery will also be contributory factors.

The inflation spiral

While it is unlikely tariffs will derail the sector’s long-term recovery, in the short term they could drive up consumer inflation, potentially dampening demand for goods and housing. This would have a wider impact on economic growth, including sales of construction equipment. While larger manufacturers can move production to new locations to avoid the worst impacts of tariffs, supply chains are globally integrated, so it is unlikely they can avoid tariffs altogether.

Interact Analysis expects to see some short to midterm increases in machinery prices, slowing demand and possibly benefitting rental fleets. A “wait and see” approach may well be adopted – particularly given the rate at which trade deals and tariff agreements are being announced – potentially putting the brakes on global market growth until the situation is clear.

Alastair Hayfield from Interact Analysis

Alastair Hayfield, Interact Analysis VP of Research – Commercial Vehicles, says, “In the longer term, we are still very optimistic about increasing demand for all types of off-highway vehicles. 2025 should be a better year than 2024. However, that has more to do with 2024 being so poor rather than conditions being amazing in 2025. In reality, it’s likely to be 2026 before the overall global market starts to perform strongly again, as we wait to see what the impacts of tariffs will be.”