TradingPedia and the EVs in Europe

Demand for EVs in Europe: Norway nears 100% EV adoption, Bulgaria and Croatia still under 10%

We have gathered information on EVs in Europe from a different perspective, that of Michael Fisher, a data scientist at the financial analysis platform TradingPedia. “I am reaching out with highlights from our latest report, which sheds light on the sales of electric vehicles in Europe and the brands selling the most units in 2025.

EVs data from ACEA

To outline which nations in Europe are leading or falling behind in the shift to electric mobility, our team at TradingPedia analysed EVs sales in Europe using new car registration data from the European Automobile Manufacturers’ Association (ACEA) for January-September 2024 and 2025. We also examined the top-selling brands and compared the revenues of leading automotive groups using their official financial reports for the same period.

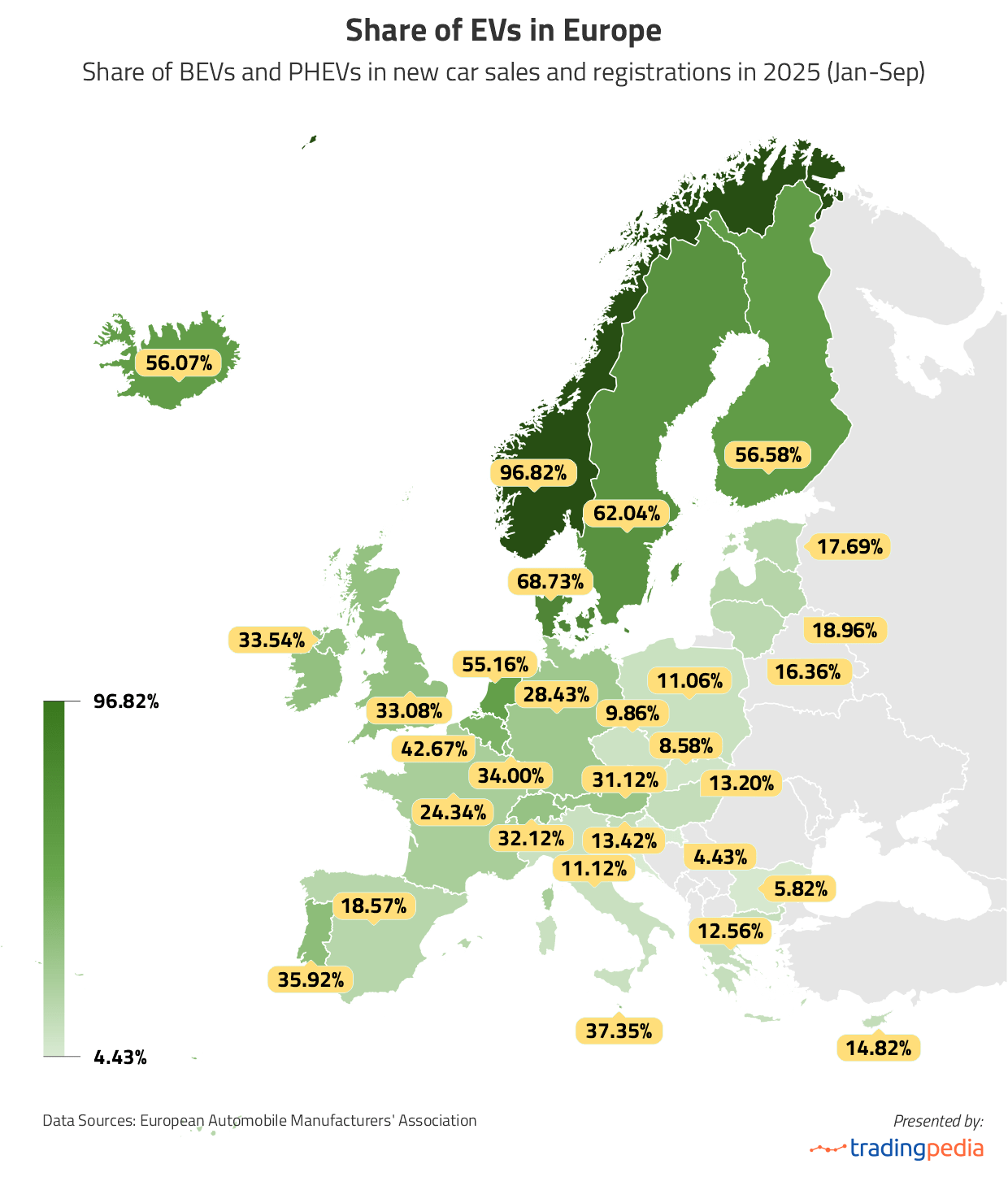

Scandinavians do it better

Recent data highlights the Nordics as the clear frontrunners in Europe’s shift to electric mobility, with Sweden and Denmark each seeing more than 60% of new cars registered as either battery-electric or plug-in hybrids, whereas Norway is in a league of its own, reporting an extraordinary 96.81% EV share. Eastern Europe, however, continues to lag, with countries such as Slovakia, Croatia, and Bulgaria still below the 10% mark.

EVs (BEVs and PHEVs) in Europe

Here are a few key takeaways from the report:

- Norway is racing towards 100% electric adoption, with 107,606 battery-electric cars and 2,198 plug-in hybrids registered so far in 2025, a share that puts 96.8% of all new vehicles firmly in the fully electric column. EV registrations continue to surge, rising 31.5% year on year, even as plug-in hybrids fall by 14.3% Interestingly, new registrations of conventional hybrids plunged by 66% in the same period.

- Denmark, Sweden, Finland, and Iceland are not far behind, reporting EV shares of 68.73%, 62.04%, 56.58% and 56.07%, respectively. Finland has seen the biggest leap in the Nordics, with its EV share of all newly sold cars surging by almost 18 percentage points since 2024. Among these countries, Denmark is the only one to record a sharp fall in plug-in hybrid sales, down 29.35% from 2024.

- The lowest EV shares of new vehicle registrations in 2025 are found in Croatia(4.43%), Bulgaria (5.82%), and Slovakia (8.58%), where petrol and diesel still dominate the market. Bulgaria stands out in particular, with petrol and diesel cars accounting for 90.63% of new registrations in 2025, despite EV sales rising by more than 46%. Slovakia, meanwhile, has increased its battery-electric registrations by an impressive 72.52%, whereas Croatia reports a steep decline of 51.92%.

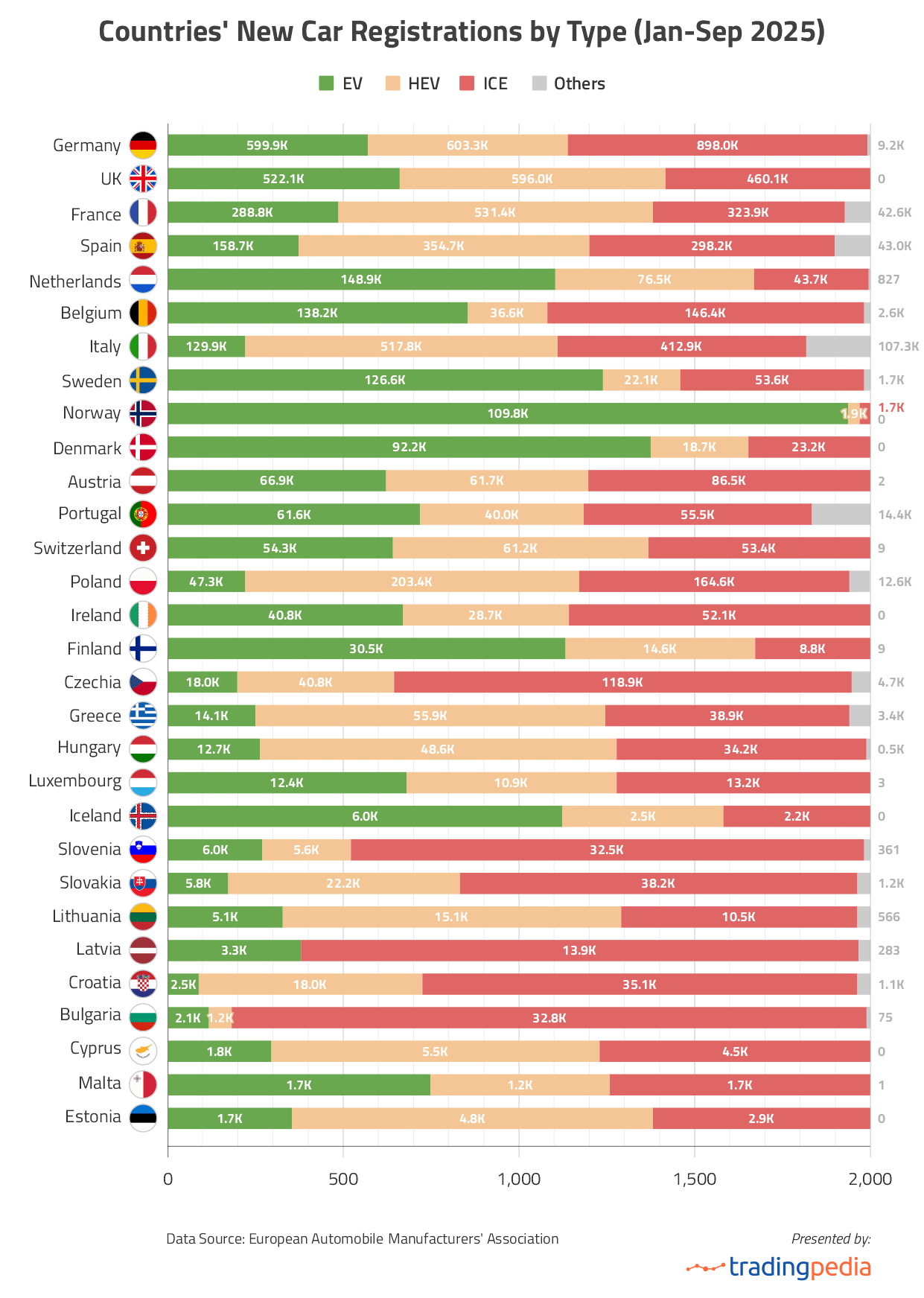

- Germany, Europe’s largest car market, continues to dominate in battery-electric vehicle (BEV) sales, recording 382,202 newly registered units, with the United Kingdom close behind at 349,414 and France at 216,310. Together, these three markets account for more than a third of all BEVs sold across the continent. While Germany and the UK saw total EV sales (BEV + PHEV) soar by 46.6% and 32.2% respectively, France experienced an 8.6% decline, largely reflecting a steep fall in plug-in hybrid registrations.

- In a surprising turn, hybrid-electric vehicles (HEVs) have emerged as Europe’s top choice for new car buyers in 2025, claiming 34.8% of total registrations and overtaking petrol cars (27.2%) for the first time. Electric vehicles (EVs) are close behind at 27.3%, underscoring a clear and accelerating shift toward electrified mobility across the continent.

‘Europe EVs market is evolving into a study of contrasts. Norway’s near-total adoption demonstrates that a combination of policy, incentives, and infrastructure can drive almost complete electrification, while countries like Bulgaria, Croatia and Slovakia reveal persistent structural and economic hurdles that could slow the EU’s broader green transition.

The surprising dominance of hybrid-electric vehicles indicates consumers are hedging bets, favouring transitional technologies as fully electric adoption struggles with cost and charging access. Looking ahead, Europe risks a two-speed electrification landscape: frontrunners pushing aggressively toward BEVs, while laggards require urgent policy support to prevent widening market disparities, shaping both manufacturer strategy and the continent’s climate trajectory.’