Interact Analysis ranked the top suppliers for EV powertrains

The consulting specialists from Interact Analysis have recently published a study reporting the top suppliers for EV powertrains, particularly focused on the truck & bus sector. The report highlighted some relevant trends in a crucial sector.

The consulting specialists from Interact Analysis have recently published a study reporting the top suppliers for EV powertrains, particularly focused on the truck & bus sector. Here’s the link to the full report, which highlighted some relevant trends in a crucial sector.

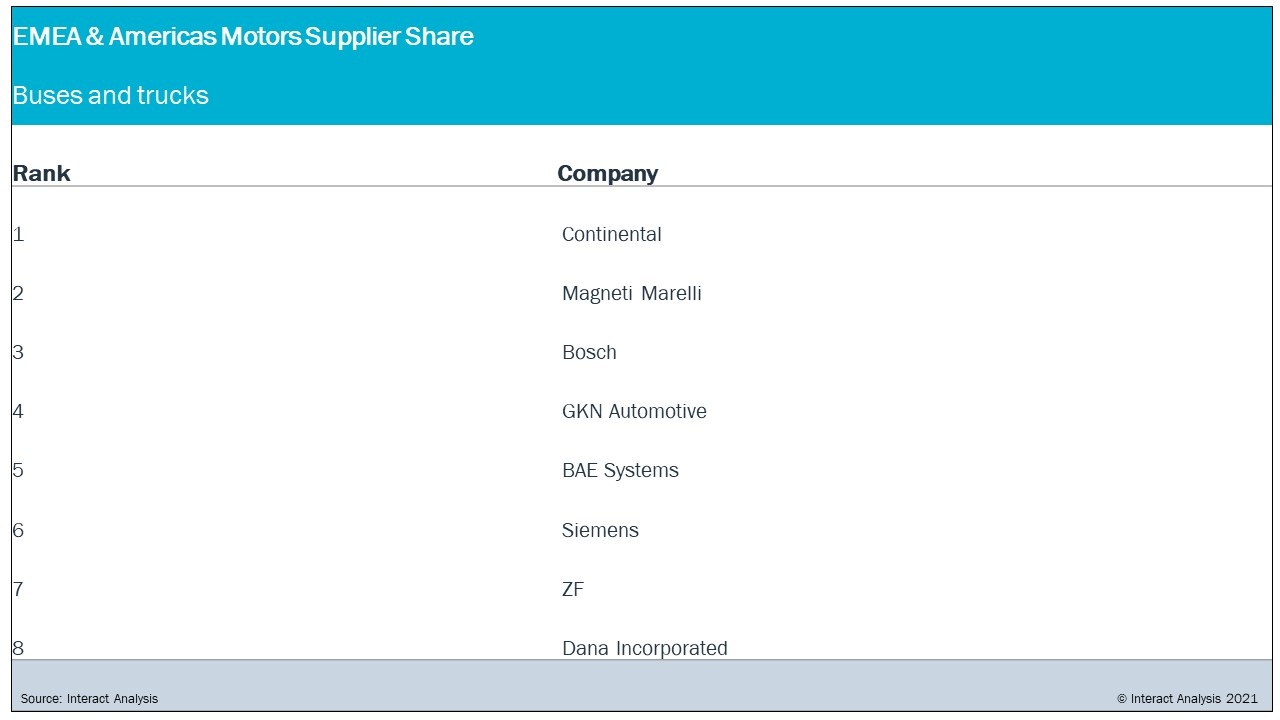

More into detail, among buses and trucks, the EMEA & Americas motors supply share is led by Continental, ranked first before Magneti Marelli and Bosch (see chart below).

The top suppliers for EV powertrains

That’s how the author Jamie Fox comments the chart: «As the transition to electric vehicles begins to build up some serious momentum in the bus and truck market, Continental is an early leader for traction motors in trucks and buses. With so few electric buses and trucks sold so far, it’s currently possible to get to the top of the leader board by having 1 or 2 major deals, even without a broad customer base. Most of the units from Continental and Magneti Marelli are from the RAM 1500 e-Torque, with Continental thought to be supplying the motor for the V6 version of the vehicle and Magneti Marelli for the V8».

And about some possible future trends, he adds: «Given this reliance on a single deal for the majority of a supplier’s units, it’s easy to see how this picture could dramatically alter within the space of a year or two as new vehicles come on to the market and OEMS consider different suppliers or dual supply arrangements. There are also some companies, such as Cummins and BorgWarner for example, that are capable of competing strongly in the commercial vehicle space but do not appear in the ranking list at all for 2020».

A chart for the batteries

As for the batteries, the chart below concerns three categories: cell suppliers, pack supplier and OEMs. Its shows some of the major suppliers, without mentioning market shares. Again, these are the words written by the author: «Often a battery pack is not sold but instead produced in-house or packaged internally by an OEM or powertrain supplier after buying cells. A battery pack market share was not produced for this report; however, some of the major suppliers in the supply chain are shown below».

The big names as for hydrogen

A relevant part of the study was indeed dedicated to hydrogen. «Ballard is the top supplier of fuel cells. Other players include Hydrogenics and Intelligent Energy. Luxfer and Hexagon were the leading supplier in 2020 of hydrogen tanks. Others include Worthington, NPROXX, Quantum and Iljin. In this area, the market is not as diverse as batteries and motors, with the suppliers mentioned above accounting for an estimated 85 percent of the combined revenue of hydrogen fuel cells and tanks», adds Jamie Fox from Interact Analysis.