Liebherr: record turnover in 2022

The Liebherr Group finished the year 2022 with a new record turnover of €12,589 million. Compared to the previous year, the company thus recorded a turnover growth of €950 million or 8.2%.

The Liebherr Group finished the year 2022 with a new record turnover of €12,589 million. Compared to the previous year, the company thus recorded a turnover growth of €950 million or 8.2%.

Difficult general conditions, rapidly rising food and fuel prices, as well as the ongoing coronavirus pandemic and related regional lockdowns weighed on economic development and slowed economic growth in the past business year. Nevertheless, Liebherr’s turnover increased significantly compared to the previous year. The group achieved increased turnovers in 10 of its 13 product segments, some of them significant. It thus surpassed its previous turnover record from 2021 by €950 million.

Turnover in the seven product segments of earthmoving, material handling technology, deep foundation machines, mobile and crawler cranes, tower cranes, concrete technology and mining totalled €8,561 million, 6.9% above the previous year’s level. In the six product segments of maritime cranes, aerospace and transportation systems, gear technology and automation systems, refrigerators and freezers, components and hotels, Liebherr achieved a total turnover of €4,028 million, an increase of 11% over the previous year.

Turnover increased slightly in the European Union, which is traditionally the Group’s strongest sales region. Growth rates in the EU markets varied, with business developing positively in the Netherlands and Italy in particular. Liebherr developed extremely positively in North America and in Central and South America, with strong growth impulses coming from the USA and Canada, and again from Brazil. The Group also recorded a pleasing increase in Africa as well as in the Near and Middle East. Turnover in Asia and Oceania was slightly above the previous year’s level.

The Liebherr Group achieved a net income of €2 million in 2022. Operating results and the financial result decreased significantly compared to the previous year. The number of employees grew again in the 2022 business year. At the end of the year, the Liebherr Group had a total of 51,321 employees worldwide. Compared to the previous year, this constituted an increase of 1,710.

Traditionally high investments in research and development

As a technology company, the Liebherr Group pursues the goal of making a decisive contribution towards technological progress in the sectors relevant for the Group. Last year, the Group therefore invested €588 million in research and development. The bulk of this was used in the development of new products. Numerous cooperative ventures with universities or higher education institutions and research institutes were initiated or continued.

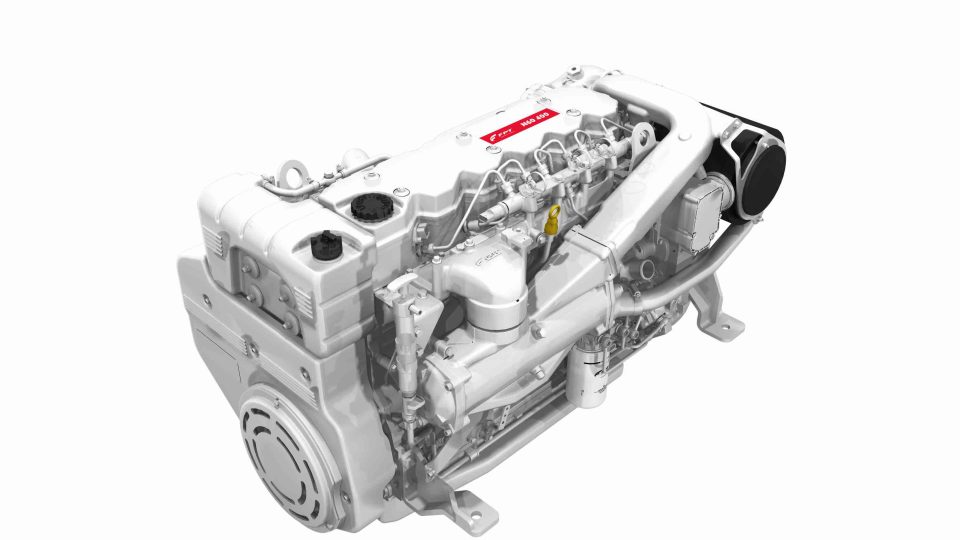

Alternative drive technologies continue to be a focal point of the research projects at Liebherr. As part of its technology neutral approach, which takes into account the most diverse areas of application and product requirements of customers worldwide, the Group is working, among other things, on the increased use of hydrogenated vegetable oils (HVO). The fuel, which is derived from renewable energy sources, can be used directly in a large proportion of Liebherr’s construction machinery, cranes and mining machines, thus also significantly reducing CO2 emissions from existing fleets. An absolute novelty is the R 9XX H2: the crawler excavator, which won the Bauma Innovation Award for Climate Protection, is powered by Liebherr’s H966 hydrogen combustion engine and emits almost no CO2 during construction site operation. Liebherr also continued its research into fuel cell systems for the aviation industry. The first of these systems was successfully commissioned in 2022.

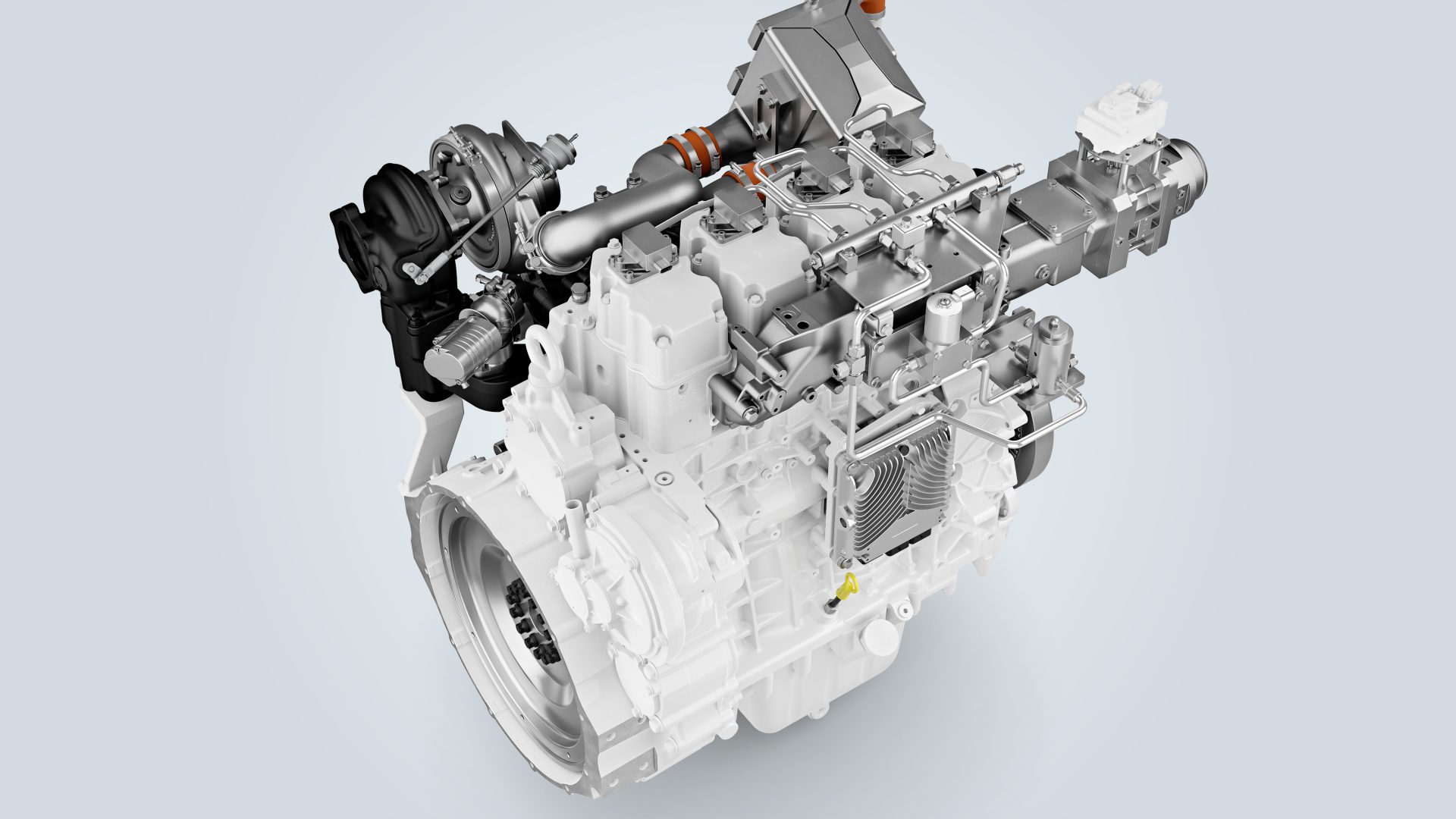

In the field of electric drives, since the previous business year, Liebherr has added six new models to its Unplugged range, which consists of battery-powered, locally emission-free crawler cranes as well as piling and drilling rigs up to 400 tonnes. Furthermore, the new LTC 1050-3.1 E compact crane is equipped with an electric motor in addition to the conventional drive. Another new development from Liebherr is the Liduro Power Port (LPO) mobile energy storage system for supplying power to hybrid or fully electric construction machinery and equipment on construction sites.

Digitalisation was another focal point of the Group’s R&D activities. The new LICCON3 crane control in the LTM 1110-5.2 and LTM 1100-5.3 models laid the foundation for a new, digitised generation of mobile cranes. Among other things, LiTool, a design and simulation program for increased quality of gear cutting tools, was further developed. In the components segment, Liebherr implemented various camera-monitor systems and all-round vision solutions. In concrete technology, the development of a software for control technology, which will be used for collecting and processing data for process optimisation, started. In addition, existing technologies for remote control, automation and networking were optimised in several product segments. Work was carried out, for example, on the Liebherr-Remote-Control (LiReCon) teleoperation system. With it, both cranes and earthmoving machines such as excavators, wheel loaders and dozers can be controlled safely and conveniently from a distance. Liebherr has also made further developments in the area of assistance systems over the past year. Particularly noteworthy is the expansion of the assistance systems for mining trucks to include the Trolley Guidance and Crusher Guidance systems, which increase operating efficiency and operational safety.

Outlook for 2023

The Liebherr Group has started the year 2023 with a positive order situation. With regard to the war in Ukraine, however, there is still great uncertainty as to whether and to what extent a gradual easing will occur, whether the sanctions will remain in force and whether a gas shortage, which would result in rationing, can be avoided. At the same time, there are still macroeconomic uncertainties about the duration and distribution of the expected decline in economic activity in Europe, the duration of broad price increases in many goods and services, and the scarcity of certain raw materials and labour. The same applies to bottlenecks in different supply chains. It is also unclear how fiscal and monetary policy measures will affect the Liebherr Group. Macroeconomically, however, lower inflation may reduce uncertainties and thus increase demand for the ’sGroup’s products and services. Following the successful previous business years, Liebherr expects further growth in turnover in 2023.

CLICK HERE TO READ THE FULL ANNUAL REPORT