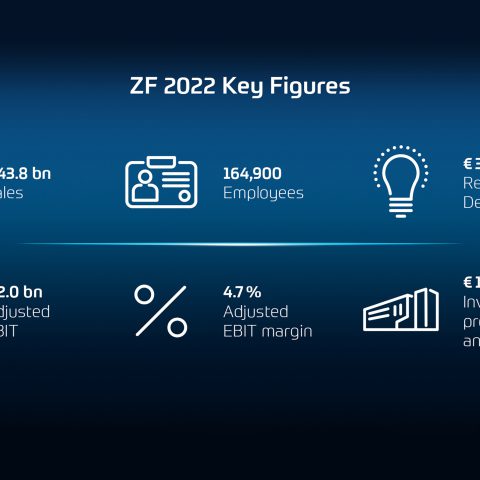

ZF: 2022 financial results

ZF achieves sales of €43.8 billion in 2022 (2021: €38.3 billion), adjusted EBIT is €2.0 (2021: €1.9) billion, adjusted EBIT margin at 4.7 (2021: 5.0) percent. Order volume for electrified drives amounts to more than €30 billion.

ZF has continued its strategic course in the extraordinarily demanding year of 2022 and set the course for future economic development. Some areas will be opened up to potential partners and investors. Others should be able to act more efficiently and closely with the customer through mergers. These steps aim to align ZF more clearly with future fields and make it more profitable.

In the 2022 financial year, the company generated sales of €43.8 billion, an increase of 14 percent compared to the previous year. Adjusted EBIT was €2.0 (2021: €1.9) billion; the adjusted EBIT margin was 4.7 (2021: 5.0) percent.

With these results, ZF has achieved its forecast adjusted in the fall. But from the company’s point of view, they are not sufficient to cope with an accelerated change in times of transformation. “Even though we made further progress with our strategy in 2022, we cannot be satisfied with this financial result,” said ZF CEO Holger Klein at the balance sheet presentation in Friedrichshafen on Thursday. Klein has headed ZF since January 1, 2023. “Our most important task is to focus ourselves, and to push change and gain speed. We have launched a comprehensive performance program to accelerate processes, simplify decision making and maintain cost discipline.”

The efficiency gained will enable ZF to make targeted investments in high-yield, future-oriented technologies. Based on the “Next Generation Mobility” strategy, ZF is further developing its corporate structures to better adapt them to the requirements of customers and the market. ZF is therefore planning, among other things, to unite the two divisions for Car Chassis Technology and Active Safety Systems into a new division for chassis, steering and brake technology that is unique in the market. “The new division offers all the hardware, software and electronics needed to control the vertical, longitudinal and lateral dynamics of a vehicle. With a turnover of more than €14 billion, it should be a strong partner for our customers from the start,” explained Klein.

ZF is setting up some business areas independently so that they can grow faster and operate more successfully in the market. “We are looking for external investors as partners for attractive areas with very good growth potential and high investment requirements,” said Klein. These include the Passive Safety Systems Division, the conventional car axle business and the business with autonomous shuttles.

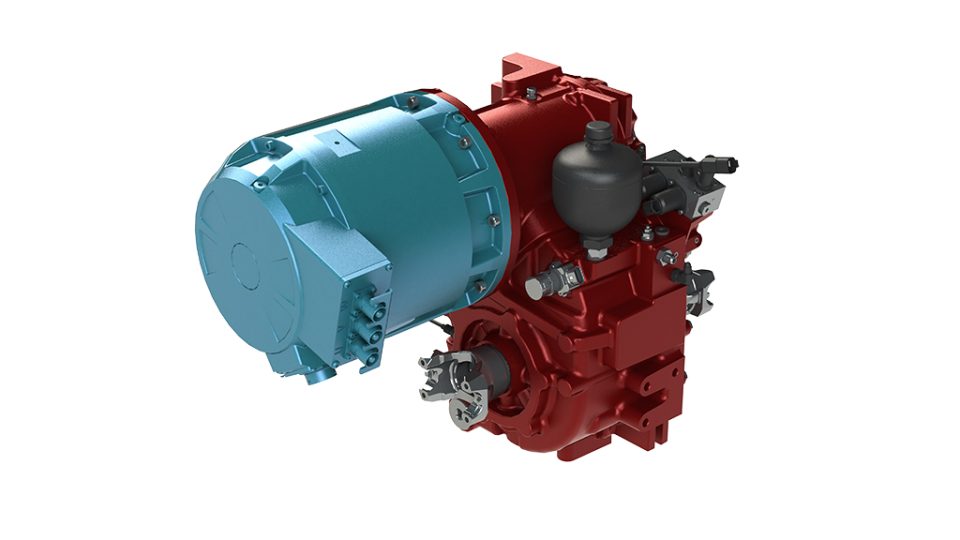

The areas of aftermarket and electric drives, among others, have developed successfully. The ZF Aftermarket Division won over its customers with more digital solutions and services and increased its sales again (2022: up six percent to €3.2 billion). In e-mobility, the order backlog for electrified drives for passenger cars and commercial vehicles now amounts to more than €30 billion. This enables ZF to make the transition from classic transmissions to electric drive solutions.