[Interact Analysis] Toyota topped fuel cell system installation for CV in China

In February 2023, registrations of new energy commercial vehicles in China totaled 14,224, up by 136% year-on-year. The landscape for fuel cell vehicles is very dynamic in China and Toyota led the way for fuel cell installations in February 2023, as we read in this insight by Shirly Zhu, Principal Analyst at Interact Analysis.

According to the new insight by Interact Analysis, sales of new energy commercial vehicles in China returned to growth in February, with registrations totaling 14,224 units, up by 136% year-on-year and increasing by 123% on the previous month. Of the total registrations for February, new energy trucks accounted for 5,173 units, while a total of 9,051 new energy buses were delivered, registering annual growth rates of 55% and 237% respectively.

Within the new energy commercial vehicles segment, the landscape for fuel cell vehicles in particular is dynamic and experiencing rapid change in China, with new fuel cell vendors entering the market and Japanese company Toyota leading fuel cell installations for commercial vehicles during February 2023.

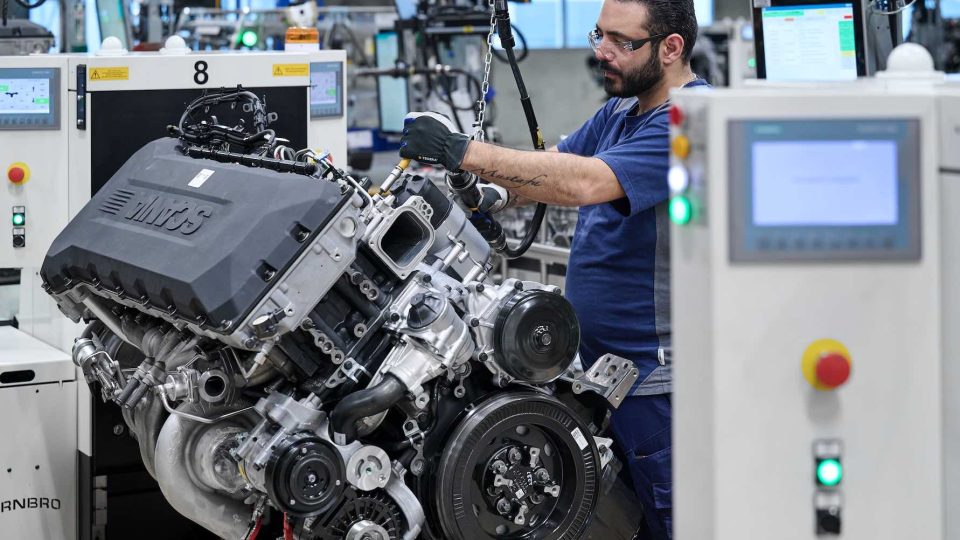

Booming vehicle sales are driving the installation of powertrain components, including battery systems, motors, and other parts. According to our monthly tracker, more than 1.1 GWh of batteries were installed for new energy buses and trucks in China in February 2023, representing 68% year-on-year and 38% month-on-month growth. In addition, a total of 14,239 drive motors were installed in new energy commercial vehicles, marking an annual increase of 135%.

Diversification of fuel cell system suppliers

Currently, the fuel cell vehicle industry is still at its infancy and the landscape is changing fast, thereby the supply of fuel cell systems for buses and trucks is very dynamic. In February, 10 fuel cell system vendors supplied a total of 127 fuel cell systems for buses and trucks, with a total installed power rating of around 10,300 KW. Toyota ranked top in terms of both installation units and power rating, with respective market shares of 47.2% and 43.4%. Toyota’s outstanding performance during the month in question was largely related to the installation of systems for COASTER fuel cell buses at FTCC (FAW Toyota) – a joint venture between FAW and Toyota.

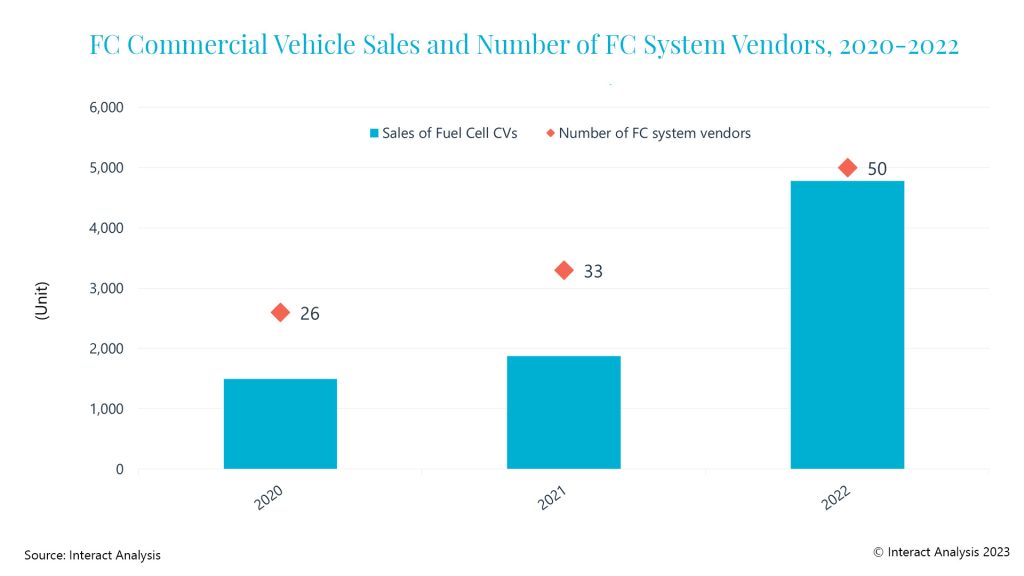

Since the rollout of pilot fuel cell projects in August 2021, sales of fuel cell buses and trucks have started to take off, attracting a growing number of fuel cell system companies to the market. In 2022, 50 vendors had installed fuel cell systems in buses and trucks in China, and we spotted 6 new companies entering the market by commencing fuel cell installation in the first two months of 2023.

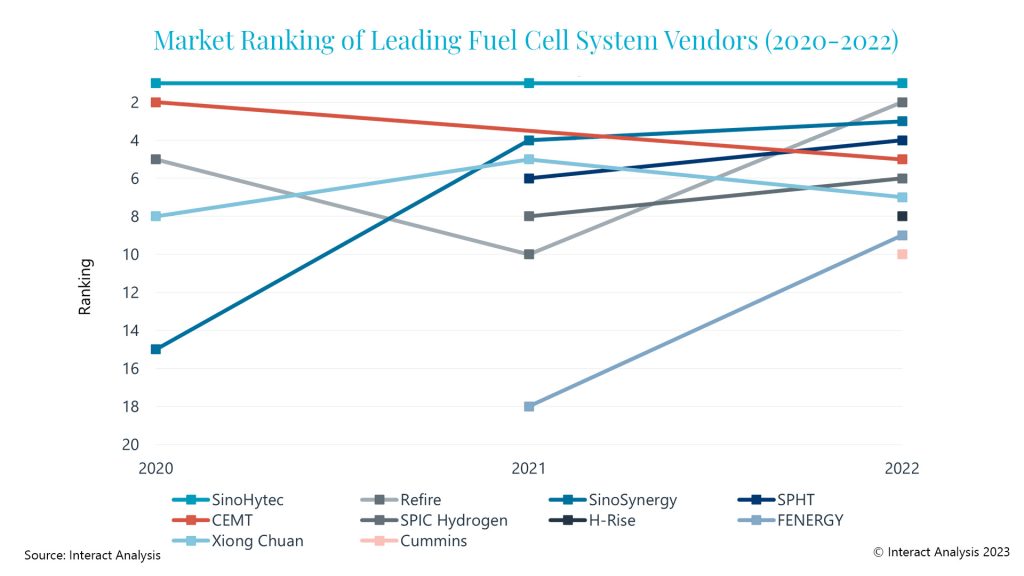

The performance of fuel cell system vendors is very much dependent on installation for a couple of major OEM partners. As shown in the chart below, SinoHytec was the only company maintaining its leading position for installed fuel cell power rating in China for three consecutive years to 2022.

It’s worth mentioning that vehicle OEMs also engage in the business of fuel cell systems – this is very similar to the trend for other key powertrain components like battery systems – largely for the purpose of protecting their supply chain. For example, FTXT was founded by Great Wall Motor, while SHPT is a subsidiary of SAIC Motor. Nevertheless, independent fuel cell system suppliers remain key players in the market.

One significant difference from the supply of battery systems and drive motors for new energy buses and trucks (which are dominated by the Chinese local vendors with little presence of foreign brands) is that global companies led by Bosch, Cummins, Toyota (joint ventures) are active in the supply of fuel cell systems. The fuel cell systems market has benefited from a range of factors, including technological advantages, and fewer barriers to subsidies regarding whether vehicles are equipped with domestic or foreign fuel cell systems than previously applied to battery electric vehicles.

In addition, global suppliers have made significant attempts to capitalize on the fuel cell systems market in China. For example, Bosch founded a joint venture with Qingling Motor Group to specialize in fuel cell systems. In 2022, Bosch ranked 11th out of total installed fuel cell system power rating, with over 40% contributed by Qingling Motor. In March, Toyota Motor signed a strategic co-operation framework agreement with Haima Automobile Group to supply MIRAI fuel cell systems for passenger vehicles in 2023.

As the Chinese market for fuel cell vehicles leaps forward, more and more fuel cell system vendors are expected to enter the market in the coming few years, with global companies likely to play an important role in the country’s fuel cell systems market in the future.