Deutz: 2022 results

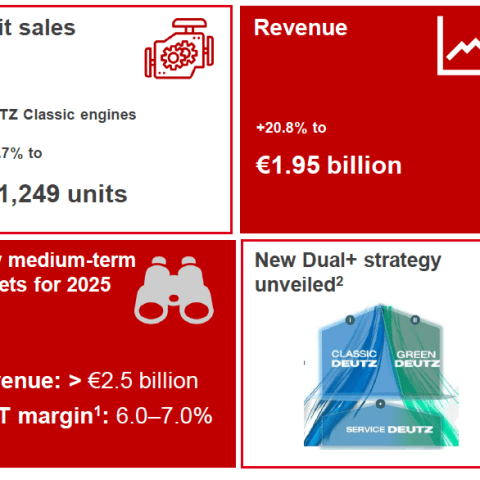

Last year, Deutz maintained its course and achieved its targets in a challenging geopolitical and macroeconomic environment. The drive manufacturer’s unit sales rose by 16.6 percent, while revenue climbed by 20.8 percent to €1.95 billion. Profitability also improved significantly, with EBIT before exceptional items more than doubling year on year to reach €89.4 million.

In 2022, Deutz maintained its course and achieved its targets in a challenging geopolitical and macroeconomic environment. The drive manufacturer’s unit sales rose by 16.6 percent, while revenue climbed by 20.8 percent to €1.95 billion. Profitability also improved significantly, with EBIT before exceptional items more than doubling year on year to reach €89.4 million. The EBIT margin before exceptional items widened from 2.3 percent to 4.6 percent.

“Despite difficult conditions, we maintained our course and significantly improved our earnings, giving us a base on which to build. In January, we unveiled our Dual+ strategy in order to cater to the different needs in the market and lay the foundations for our continued growth in the years ahead. The shift to greener drive systems represents a huge business opportunity for us,” says Deutz CEO Sebastian C. Schulte.

Deutz 2022 results: new medium-term targets based on the Dual+ strategy

Aimed at additional growth and greater profitability, the Dual+ strategy adopted by Deutz at the start of this year encompasses both the optimization of its existing core business in internal combustion engines and the development of new zero-emission products. The two segments will be supported through the global expansion of the service business. The target under the new strategy is to increase revenue by almost 30 percent to more than €2.5 billion by 2025. The service business is to contribute around €600 million to this total. Over the same period, the aim is for a rise in the EBIT margin before exceptional items to between 6 percent and 7 percent. Deutz’s long-term objective is to permanently establish itself among the top three independent drive manufacturers and to offer a fully climate-neutral product and technology portfolio by no later than 2050.

Classic segment provides foundations for growth

In the Classic segment, Deutz increased its EBIT margin before exceptional items to around 7 percent, thereby recording its best performance in more than ten years. This business will continue to underpin Deutz’s growth over the coming years. An optimized product portfolio, more efficient processes, and a significant improvement in performance should enable existing capacity to be utilized even more effectively. With this in mind, Deutz is intending to play an active role in a consolidating market: “Whereas some players are exiting the market, we are opting for growth by means of targeted purchases and acquisitions. The alliance with Daimler Truck is the first major step in this regard,” explains Schulte. This partnership, which was announced a few weeks ago, will enable Deutz to modernize its product portfolio quickly and efficiently. The annual revenue to be generated through the alliance is expected to be in the mid-triple-digit millions of euros after the ramp-up of production in 2028.

Technology-neutral, market-oriented development in the Green segment

Deutz is taking a fundamentally technology-open approach to the further development of its climate-neutral product portfolio in the Green segment. This means improving the carbon footprint of the internal combustion engine, for example through the use of hydrogen or synthetic fuels, and developing alternative drive systems such as electric drives. To this end, Deutz will analyze all its activities in the Green segment during the coming months in order to review their marketability. The Company previously announced that it plans to invest more than €100 million in these activities. Deutz’s hydrogen engine is already being piloted in two projects in Germany and, in February 2023, a memorandum of understanding was signed regarding the delivery of a first small-scale production run of H2 gensets to China.

Global expansion of the service business

Deutz will also continue to expand its profitable service business under the new Dual+ strategy. This includes the enlargement of regional sites, the repair and maintenance of non-Deutz engines, and the expansion of the service business through acquisitions and strategic partnerships. In 2022, companies were acquired in Ireland and the Netherlands.

DOWNLOAD HERE DEUTZ’S KEY FIGURES FOR 2022 IN DETAIL