Case Construction Equipment

Case Construction Equipment boasts a complete and articulated lineup and an ancestral attraction for the New Continent, where it was established 176 years ago by Jerome Increase Case. After all, the brand in this sector is identified as a ‘full liner’. Under the bonnets the Fpt hegemony is diluted by the large delegation from the […]

Case Construction Equipment boasts a complete and articulated lineup and an ancestral attraction for the New Continent, where it was established 176 years ago by Jerome Increase Case. After all, the brand in this sector is identified as a ‘full liner’. Under the bonnets the Fpt hegemony is diluted by the large delegation from the Rising Sun – Isuzu, Kubota, Mitsubishi, Shibaura, Yanmar – inherited from the collaboration with Sumitomo and the Japanese paternity of compact machines. We talked about it with Egidio Galano, Emea product manager, and Antonio Strati, product marketing manager.

Case. Galano and Strati say

How would you summarize the engine strategy of Case Construction Equipment?

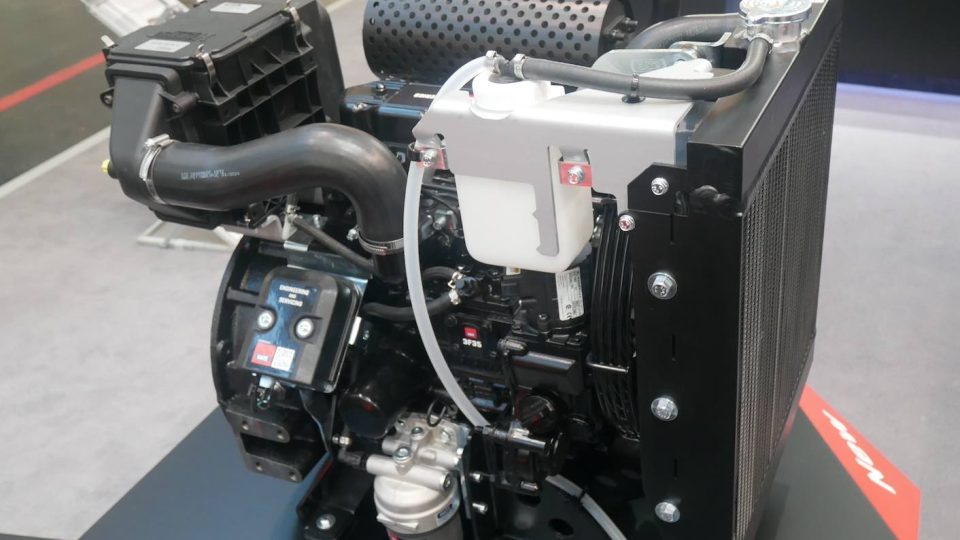

Several technologies coexist under the same roof, following a couple of common directions, first of all the ostracism to particulate filter on Heavy Line machines. Following the alliance with a Japanese partner, we fit on excavators a 4 and a 6 cylinders by Isuzu, an exception on the heavy line that is generally faithful to Fpt Industrial which powers wheeled excavators, wheel loaders, graders, dozers and also compact loaders and backhoe loaders. The exclusion of dpf is the common denominator of the whole ‘heavy’ range, regardless of the engine brand. As for Fpt Industrial, we use the Nef 4 and 6 cylinder and the Cursor 9 on our two largest wheel loaders.

A specific sump has been developed for wheel loaders, having to cope with the inclination of the machine which often works on slopes and unstable ground. The engine is mounted above the axle together with this sump, which features an oil pump capable of transferring the oil from one side of the sump to the other based on the inclination of the machine.

And apart from Fpt?

We fit Isuzu on crawler excavators and midi, while the 3.2 liter, 36 and 50 kilowatts Shibaura is fitted on skid loaders low range. We find again Fpt on Ctl (Compact track loaders) with the F3.4. Mini machines boast a mix of Japanese mother-tongue engines, inherited from the industrial partnership: Mitsubishi, Yanmar and Kubota. Moreover Japan is renowned for engines between 1 and 2 liters. We established a long-standing partnership with Sumitomo for excavators above 7 tons, while on smaller machines we signed a more recent agreement with Hce (Hyundai construction equipment), in both cases a large part of the manufacturing takes place in San Mauro Torinese factory.

Case. What about engines?

Which are your criteria when choosing engines?

We meet the different needs of heavy and light machines. We are forced to find a compromise on compact machines, for example on 47-48 kilowatt the compliance with Tier 4 requires dpf, unlike the range under 36 kW. The FPT F34 features a light egr and an exhaust gas recirculation rate under 10 percent, which avoids dpf and reduces the dimensions of the SCR. The particulate filter is fitted below 56 kW in two Yanmar engines used on larger machines.

What about gas and hybrid engines?

Due to applications and customer needs there is no demand for alternative fuels on earthmoving machines. The hybrid, from a decade ago, has been a protagonist of the experiments of some manufacturers, including Hitachi, Komatsu and Sumitomo itself. We’re talking of market niches involving the hydraulic circuit and accumulators, without replacing the traditional engine. Rotation, inertia, boom lowering can alternate the hydraulic motor with an electric one in order to recover energy.

Stage V. What will you ask to engine manufacturers?

The main request is to meet dimensions and spaces and favor interchangeability. The Fpt Stage V formula does not include changes to dimensions and canning on installations. The technology changes within the scr module where the ScrOnFilter will be implemented, integrating the particulate treatment in the scr catalyst. There is no need to regenerate the filtering system, there is no filter maintenance, the ‘regeneration free’ Ats system is widely used, which avoids downtime and provides automatic filter cleaning. The effort was to avoid additional impacts on end user operations.

And what about the interaction between hydraulics and engine?

We are developing Stage V minimizing the impact on the vehicle, focusing on continuity. A development of electric applications could mainly involve mini-excavators, even if market and incentives trends does not seem going this way. A new technology – and this also applies to LPG and gas – involves development costs, and we must check if the customer is willing to pay for it. There is a problem regarding fuel storage for machines such as excavators, which sometimes work in environments that are difficult to access and move little, at least in certain life cycles.

A brief summary of Case Construction Equipment?

Case Construction Equipment is one of the founders of the backhoe loader concept, has historically built its success on skid loaders and has made the history of key products such as wheel loader. Its roots in the US have gradually expanded making Case Construction Equipment a global brand. Coming to excavators, machines having high technological content that are strategic on the market, we started a partnership at the beginning of the 90s with the recently renewed and strengthened Sumitomo, which planned to transfer part of its production to Europe, to San Mauro Torinese. In the past Case Construction Equipment has taken over the earthmoving division of Poclain. Another important chapter in our history is the relationship with Fiat. In 2004, Fiat Hitachi and Fiat Kobelco excavators were manufactured in San Mauro. We have a particular ability to handle different technologies. Customer service is located in Paris and on the other side of the Atlantic in Tomahawk, Wisconsin. Within the Cnh brand, Case Construction Equipment manufctures the entire range of compact and heavy machines, while in the Emea area New Holland Construction has an exclusive focus on the compact line, marketed with the yellow color through the agriculture dealer network.