Tractors and Engines manufacturers market

Global demand is weak, and the tractor market is penalizing the industry's major players, John Deere, CNH, and AGCO. In India, however, Mahindra & Mahindra

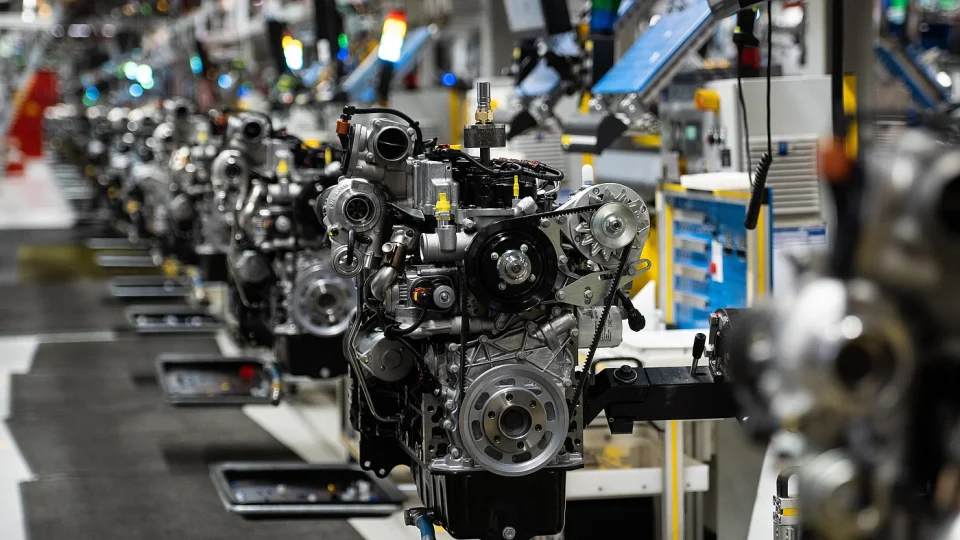

Before we delve into the first half of the three big Western agricultural machinery companies, we remind you that one is officially separated from the engine business (CNH, where FPT Industrial is part of Iveco, which was recently acquired by Tata Motors).

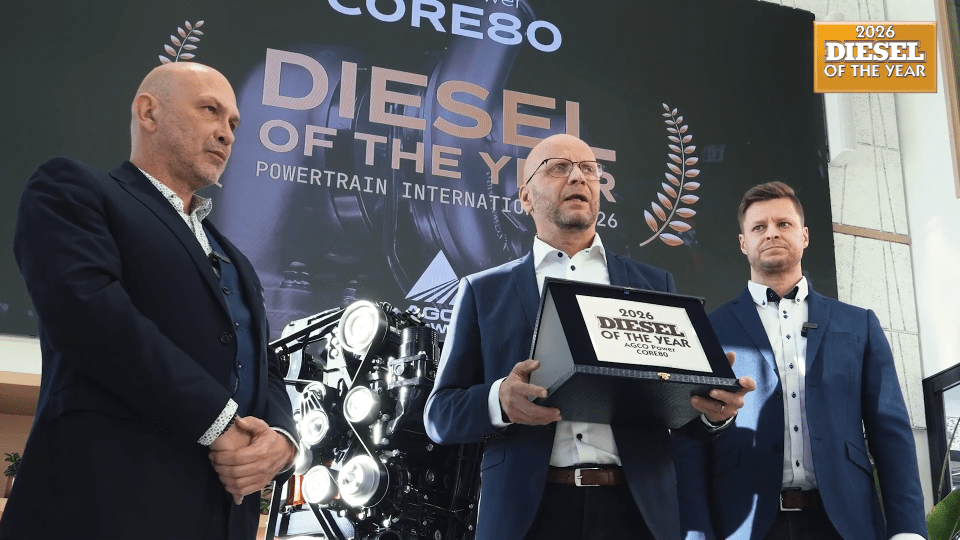

John Deere and AGCO, on the other hand, continue to produce engines primarily for internal use. John Deere Power Systems is actually also oriented towards the open market, particularly in power generation and light- and medium-duty commercial marine applications.

Tractors market is suffering

The first three quarters of 2025 have penalized the demand for tractors, thus significantly reducing the market for the main OEMs in the Western hemisphere. AGCO and CNH Industrial presented their second-quarter results and John Deere (whose fiscal year begins on November 1) their third-quarter results, highlighting a common picture: weak demand, pressure on margins, and a reduction in inventories along the distribution chain.

Few lights and many shadows

All three groups are reporting widespread declines in sales and profits, a sign of a slowing market after the boom of past years. AGCO recorded net sales of $2.6 billion in the second quarter of 2025, a decrease of 18.8% compared to 2024, and had to resort to heavy cuts in production and inventory to improve profitability. For CNH Industrial, sales in the Agriculture division fell to $3.25 billion (-17%), penalized by contracting demand and dealer destocking. The second quarter closed with a net profit of $217 million, almost halved compared to 2024. The operating margin (adjusted EBIT) fell to 8.1%, but the company has strengthened its R&D investments, which now equal 6% of sales.

What happened in rest of the world?

Let’s narrow down our overview of the tractor market to the largest global basin, India, and focus on the most recent data from Mahindra. According to official figures, Mahindra & Mahindra achieved tractor sales of 28,117 units in month of August 2025 compared to 21,917 units in August 2024, recording a growth of 28%.

The tractors sales comprised of domestic sales of 26,201 units (higher by 28% YoY) and exports of 1,916 units (higher by 37% YoY) during the month of August 2025.

Commenting on the performance, Veejay Nakra, President Farm Equipment Business, Mahindra & Mahindra said, We sold 26,201 tractors in the domestic market during August 2025, a growth of 28% over last year. The above-normal monsoon and improved reservoir levels augur well not only for Kharif crops but also for the upcoming Rabi season in October.

While the IMD’s forecast of surplus rainfall in September especially in certain pockets may pose risks to Kharif harvests, it needs to be managed with caution. All these factors, along with continued government support through financing schemes for farmers could potentially drive tractor demand during the upcoming festive season. In the exports market, we have sold 1,916 tractors, a growth of 37% over last year.