Deutz 2020 results

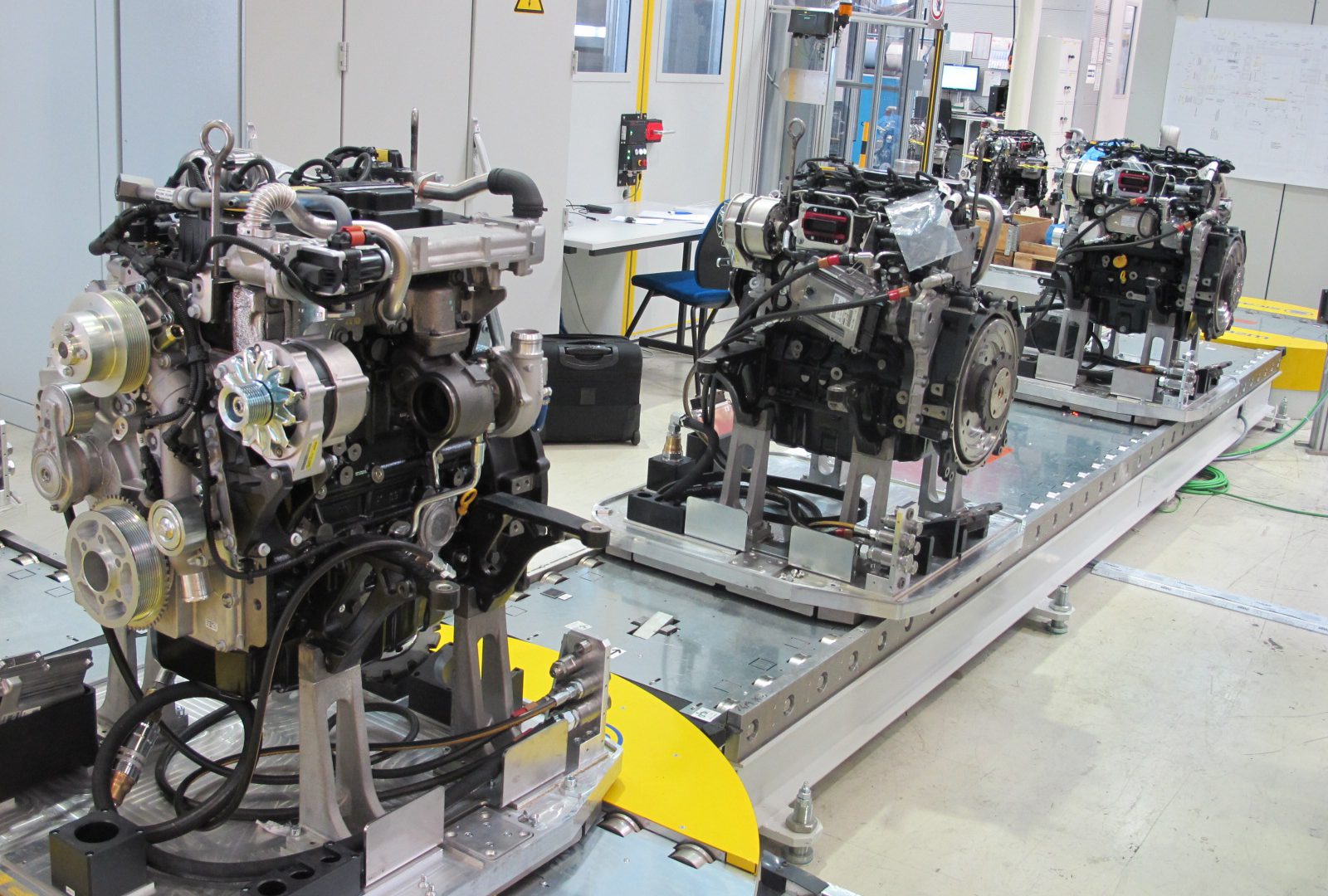

The Deutz Group sold a total of 150,928 engines in the reporting year, which was 28.7 percent fewer than in 2019.

Deutz announced its 2020 results. The Cologne-based company was able to finish a year dominated by coronavirus with a much improved fourth quarter. This is a signal that rekindles hopes of getting the company out of the depths of the pandemic within a reasonable timeframe.

Deutz 2020 results: there is light at the end of the tunnel

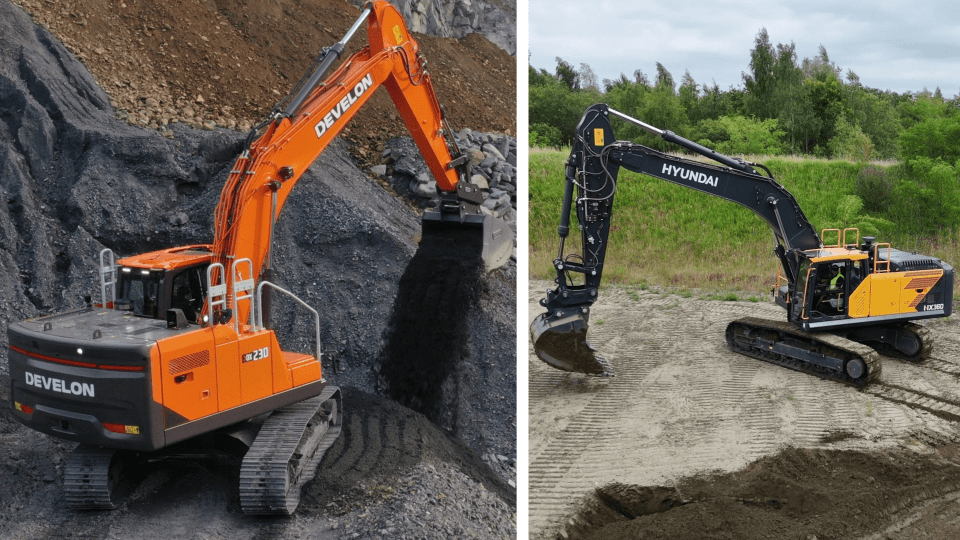

A book-to-bill ratio of over 1 was achieved for the year thanks to the pick-up in demand. Moreover, proactive management of working capital and the first positive effects from the restructuring program enabled Deutz to generate positive free cash flow of €43.0 million in the fourth quarter. There are many reasons to be positive. Take a look at China to the East. According to Deutz The joint venture with Sany, China’s biggest construction equipment group, notched up some early success by generating a profit in its first year. The production volume is set to be increased from around 20,000 engines in 2020 to around 40,000 engines in 2021. At the end of the second quarter of 2020, Deutz increased its revenue target for China for 2022 from approximately €500 million to around €800 million1 on the grounds that market demand is already on a par with the production volume planned for the joint venture and in light of the expected further gains in market share.

Growth efficiency program

According to the press release at the start of 2020, Deutz launched its Transform for Growth efficiency program in order to maintain its long-term competitiveness. The measures are aimed at optimizing the global production network, automating and digitalizing operating and administrative processes, and reducing complexity. By implementing the restructuring program, Deutz intends to achieve gross annual cost savings of around €100 million compared with the base year of 2019. The full effect is expected to be achieved from the end of 2022 onward. As well as adjusting operating costs, a large part of the savings are to be achieved by reducing staff costs. This includes a voluntary redundancy program for the German sites in order to reduce the number of employees by up to 350 with the minimum possible social impact.

Engines & revenue

The Deutz Group sold a total of 150,928 engines in the reporting year, which was 28.7 percent fewer than in 2019. Among the segments, the Other segment was the only one to see an increase in unit sales, reporting significant growth of 42.7 percent. This was due to the ramp-up of motors at Deutz subsidiary Torqeedo, which recorded a sharp rise in unit sales to 29,894 electric motors in 2020. In the core internal combustion engine business, unit sales were down by a substantial 36.5 percent. The Deutz Group’s revenue decreased by 29.6 percent to €1,295.6 million in 2020, with nearly all application segments and regions seeing a sharp reduction in revenue. The Material Handling and Agricultural Machinery application segments were hit particularly hard, registering decreases of 56.8 percent and 39.1 percent respectively. Encouragingly, the high-margin service business bucked the trend with a fall of just 1.2 percent. As a result, the share of consolidated revenue attributable to the service business rose from 19 percent in 2019 to 27 percent in 2020.

Welcome, 2021!

The industries in which Deutz’s customers operate had already begun to show signs of a gradual recovery in the second half of 2020, which led to a much improved business performance in the fourth quarter compared with the previous quarter. We currently anticipate that this trend will continue in 2021, with customers gradually becoming more willing to invest again. However, we are currently seeing difficulties with the supply of some components that will slow the upturn in the first half of the year and possibly longer. Deutz therefore anticipates unit sales of at least 130,000 Deutz engines in 2021, which should result in an increase in revenue to at least €1.40 billion. The share of revenue attributable to the high-margin service business should rise to around €400 million. We are expecting, at the very least, to break even in terms of EBIT before exceptional items. In the second half of 2021, Deutz continues to anticipate a positive exceptional item of around €60 million from the payment of the final installment of the purchase consideration for the sale of the Cologne-Deutz site. The precise amount and the exact timing depend on when the development plan for the site is formally approved by the City of Cologne.