Global chemical sector: an in-depth analysis (Part I)

Here and in the following weeks we publish an in-depth analysis of the global chemical sector, written by Joseph Chang, Global Editor, ICIS Chemical Business. We think it’s a very interesting contribution, in an era featured by the coronavirus outbreak as well as a significant fall of oil prices. The global chemical sector should […]

Here and in the following weeks we publish an in-depth analysis of the global chemical sector, written by Joseph Chang, Global Editor, ICIS Chemical Business. We think it’s a very interesting contribution, in an era featured by the coronavirus outbreak as well as a significant fall of oil prices.

The global chemical sector should prepare for an extended downturn along with lower-for-longer oil prices, both of which will have big implications for profitability and investments.

«It’s very possible that Q3 could have negative GDP as well [as Q2], and then the question is how big is the bounce back towards the end of the year?», said Rhian O’Connor, ICIS lead analyst, demand forecasting on an ICIS webinar this week.

«If everything goes back to normal on day one, we’re looking at quite a strong quarter-on-quarter growth through the second half of the year. However, a lot of people have lost their jobs, savings and businesses. We’re not all going to rush out after this crisis and buy a car or fridge», she added.

ENI AND BIODIESEL: VENICE IS WORKING HARD

The analyst also cited an Oxford Economics survey which showed more than a third of participants expecting three or more quarters of negative global GDP.

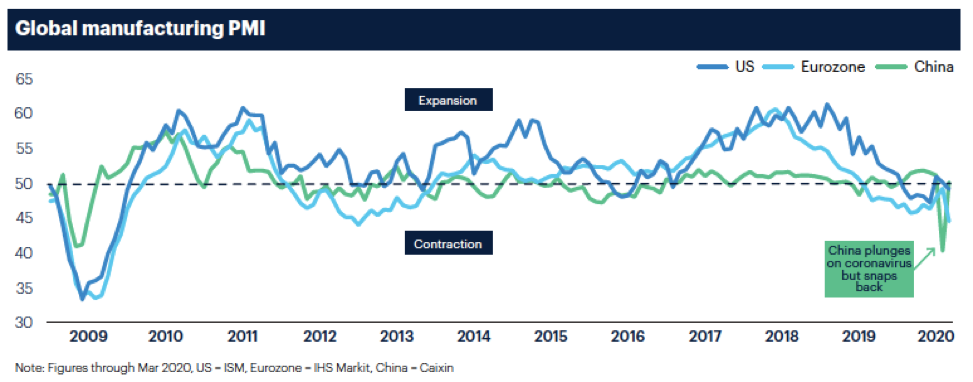

The manufacturing purchasing managers’ indexes (PMIs) show the damage thus far with the 50 level delineating expansion versus contraction in activity. The ISM US Manufacturing PMI for March fell to 49.1 from 50.1 in February while the IHS Markit Eurozone Manufacturing PMI sunk to 44.5 in March versus 49.2 in February. The Caixin China General Manufacturing PMI snapped back to 50.1 in March from a record low of 40.3 in February.

Global chemical sector: extended downturn, compressed spreads

«Our view is that demand for this year, and possibly going into 2021 will not return to pre-crisis levels», said O’Connor. «We are going to see a more extended downturn than we were expecting, and then a slower recovery than many are forecasting».

Crude oil prices will also likely be ‘lower for longer’ even if there is a deal between OPEC and Russia or if Saudi Arabia agrees to curtail production, she noted.

For petrochemicals, the spread over oil prices should also be squeezed in a global recession with lower volumes, O’Conner said.

Barbara Ortner, head of market reporting at ICIS, cited major drops for European ethylene, propylene, and benzene contract prices on 31 March. For Europe benzene, the April contract plunged a stunning 70 percent from March, settling at a record low of €171/tonne. Ethylene April contracts fell by a record €200/tonne, to €720/tonne, while propylene dropped by €175/tonne, to €650/tonne.

CASTROL AND THE IMPORTANCE OF TESTING

China bounces but outlook challenging

While China’s manufacturing economy is getting back on track and local demand is improving, it will encounter extremely difficult export conditions.

According to Jim Sheehan, US chemicals equity analyst at SunTrust Robinson Humphrey, chemical company managements are seeing a re-acceleration of demand in China with all their facilities getting back to normal.

«Companies with exposure to automotive and industrial customers are starting to run at full employment capacity but not necessarily at full operating rates», he said. «These facilities are just running to meet demand».

«With demand rebounding in China, that may sound like a positive thing but the outlook for Q2 is that we’re going to have a major economic contraction and China may not be exporting into very healthy markets. So, it remains to be seen what level of activity we normalise at in China», he added.