Acquisition completed. Akasol is now part of BorgWarner group

By taking over Akasol, BorgWarner has the target of increasing its presence in the e-mobility field and further strengthening its market position for battery systems. As a matter of fact, the US-based group is a primary player in the production of drivetrain components for the automotive industry.

BorgWarner has completed the acquisition of Akasol, a German battery manufacturer. The two companies had previously announced the negotiations as well as the signing of a business combination agreement to enter into a strategic partnership and BorgWarner will launch a voluntary public takeover offer.

Some days ago, the Darmstadt-based company announced that «shareholders of Akasol have accepted the voluntary public takeover offer by ABBA BidCo AG, a subsidiary of BorgWarner, after the extended acceptance period expired with an acceptance rate of 89.08 percent of the Akasol shares outstanding. The minimum acceptance threshold of 50 percent plus one share was thus clearly exceeded. In the partnership with BorgWarner, Akasol’s management team looks forward to approaching the next steps of the Company’s expansion with even more energy».

What’s behind the acquisition of Akasol by BorgWarner

In 2021, Akasol was able to triple Q1 revenues compared to 2020 to EUR 24 million and achieved a positive EBITDA. For the full year, the company consider an increase in revenue of up to 50 percent compared to 2020 as possible.

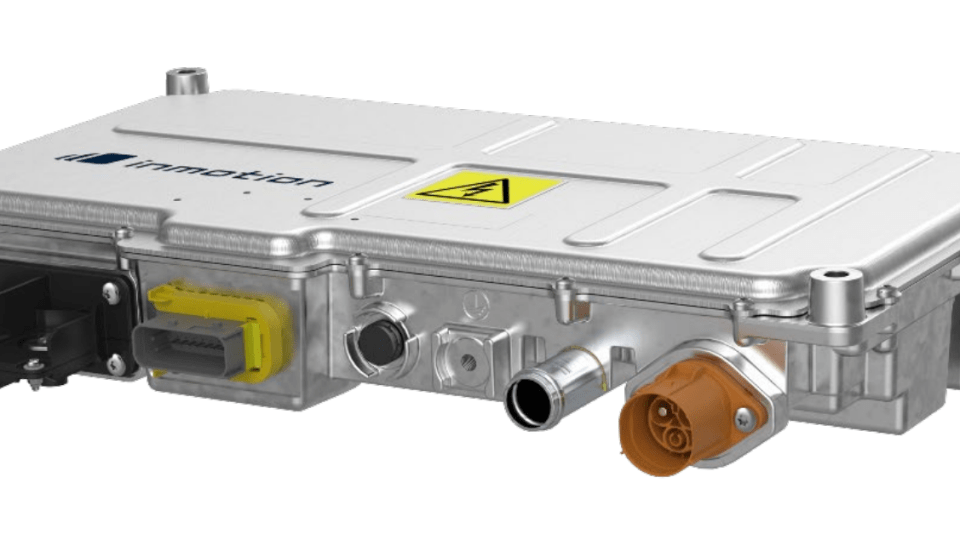

By taking over Akasol, BorgWarner has the target of increasing its presence in the e-mobility field and further strengthening its market position for battery systems. As a matter of fact, the US-based group is a primary player in the production of drivetrain components for the automotive industry.

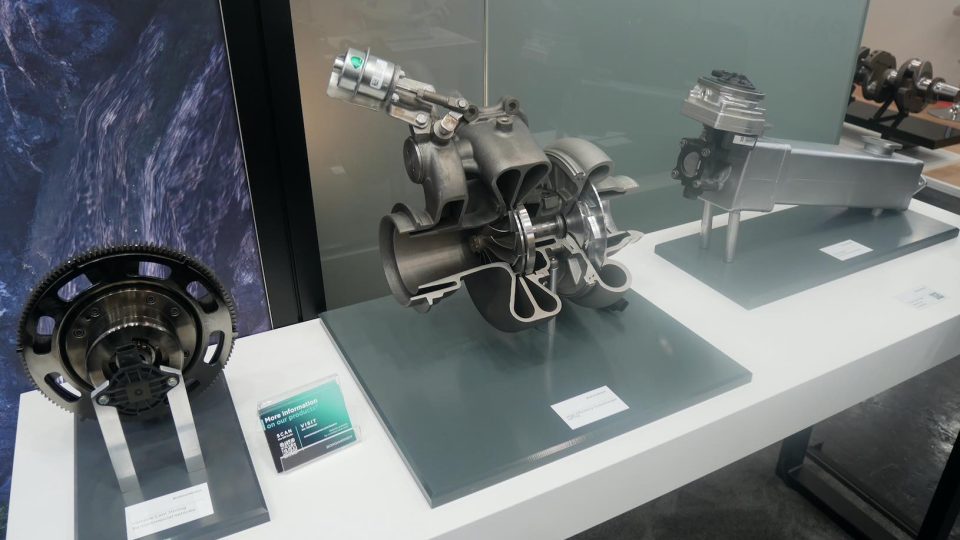

Moreover, in its 2020 Sustainability Report, BorgWarner made public that in 2019, greater than 80 percent of BorgWarner’s revenue came from electric, hybrid, and emissions-reducing combustion parts, such as turbochargers, EGR valves and coolers, engine timing systems, dual clutch transmission (DCT) and control modules, and more. As cleaner mobility adoption accelerates, BorgWarner expects to generate 36 percent of its revenue from products on hybrid and electric vehicles by 2023. Now battery systems from Akasol will help the group to expand the ’emission-free’ portfolio.

«Our expansion course continues to gain momentum», said Akasol CFO

«With BorgWarner as a strong partner on our side, we believe Akasol is well positioned to successfully realize the dynamic growth that we expect as our expansion course continues to gain momentum. For the current year, we can look back on a good first quarter», stated Carsten Bovenschen, CFO of Akasol.